Before You Ask, Know

Today’s featured startup is proving that CRM isn’t just for customers — it’s for anyone worth listening to.

Project Overview

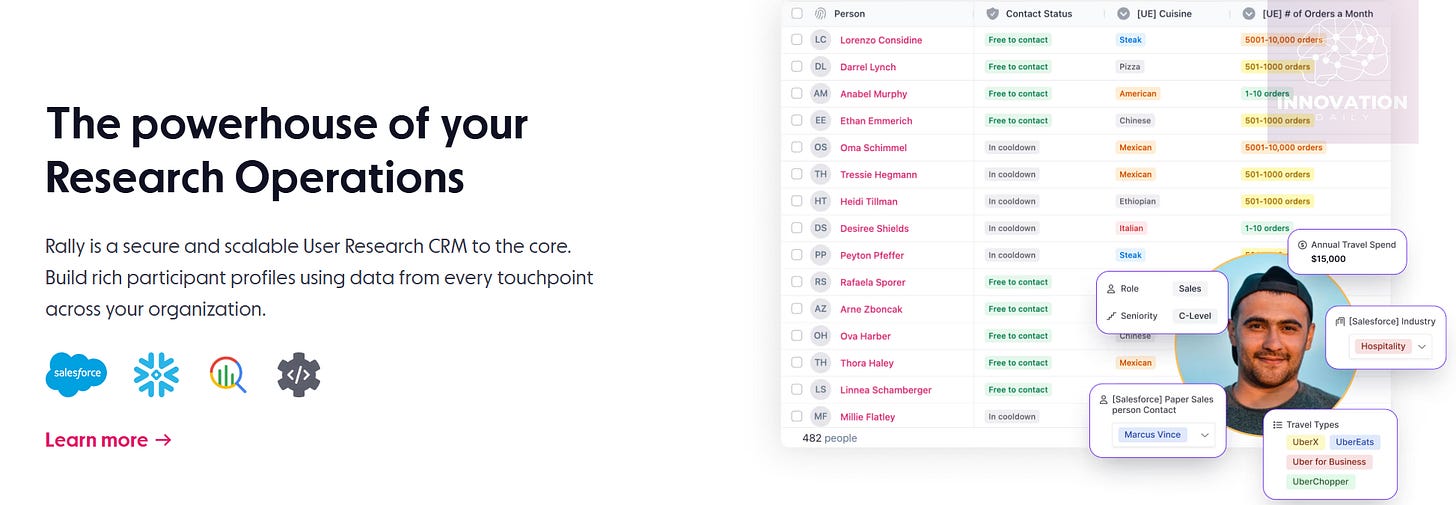

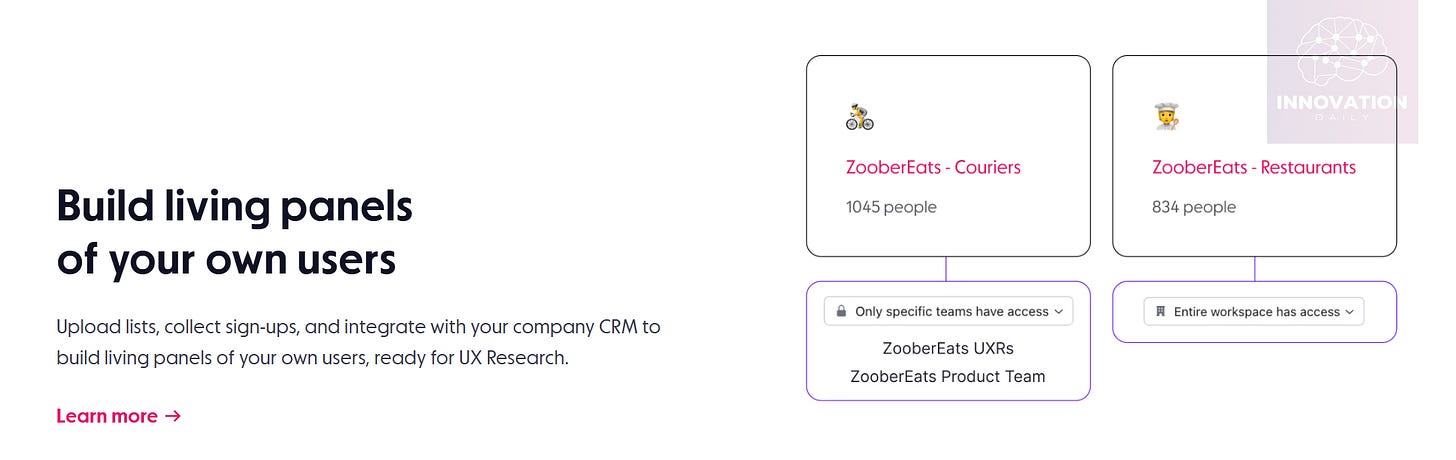

Rally presents itself as a “modern CRM” designed specifically for user research. It helps product teams streamline and scale the way they collect feedback from real users through interviews, surveys, and other methods.

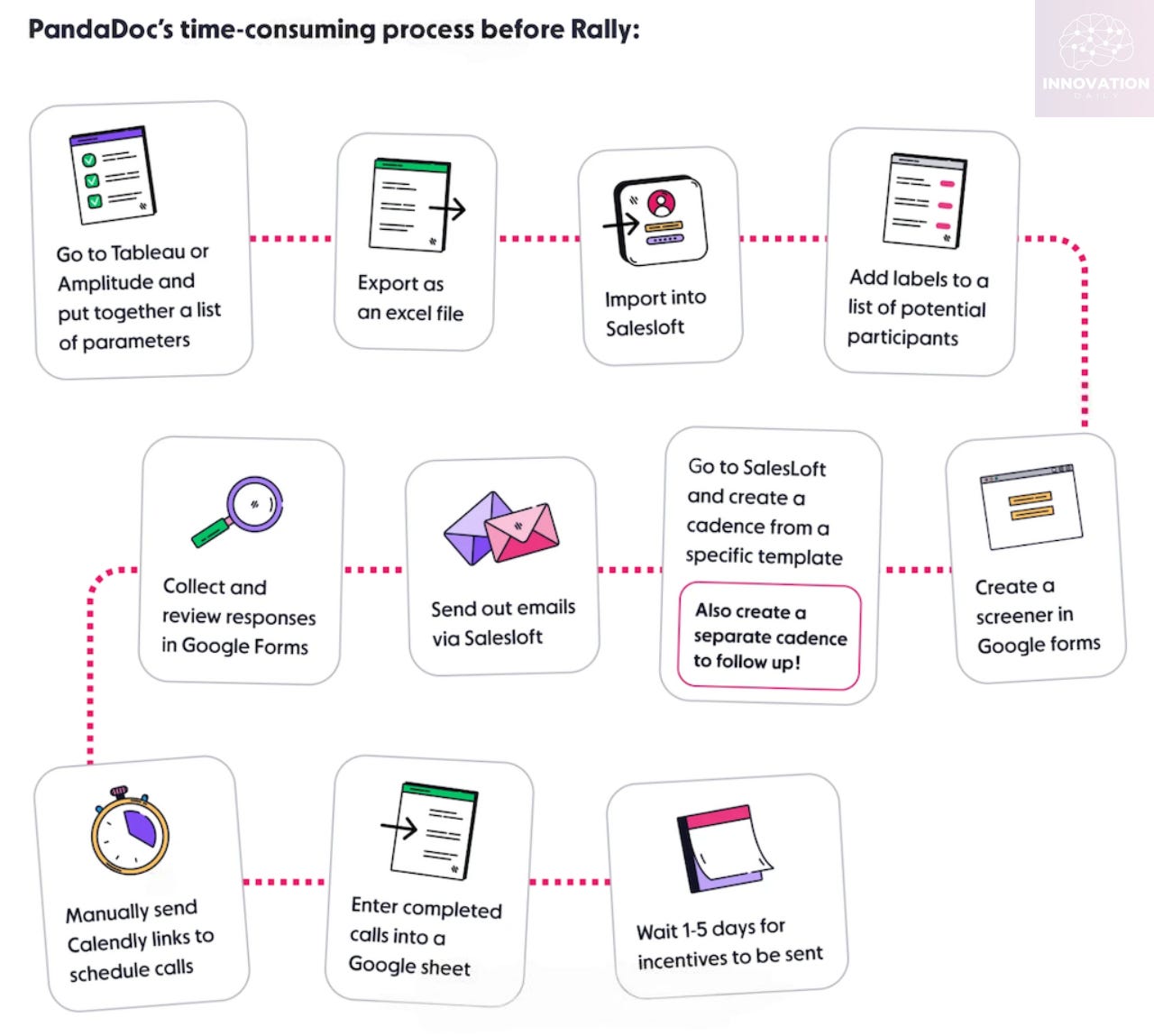

User research is a crucial step in product development — without it, building something people truly want becomes a shot in the dark. Yet, in many companies, research is scattered across departments and done manually using tools like spreadsheets and email. This fragmented approach wastes time, leads to duplicated efforts, and causes valuable insights to fall through the cracks.

Rally fixes this by centralizing user research into one coordinated platform.

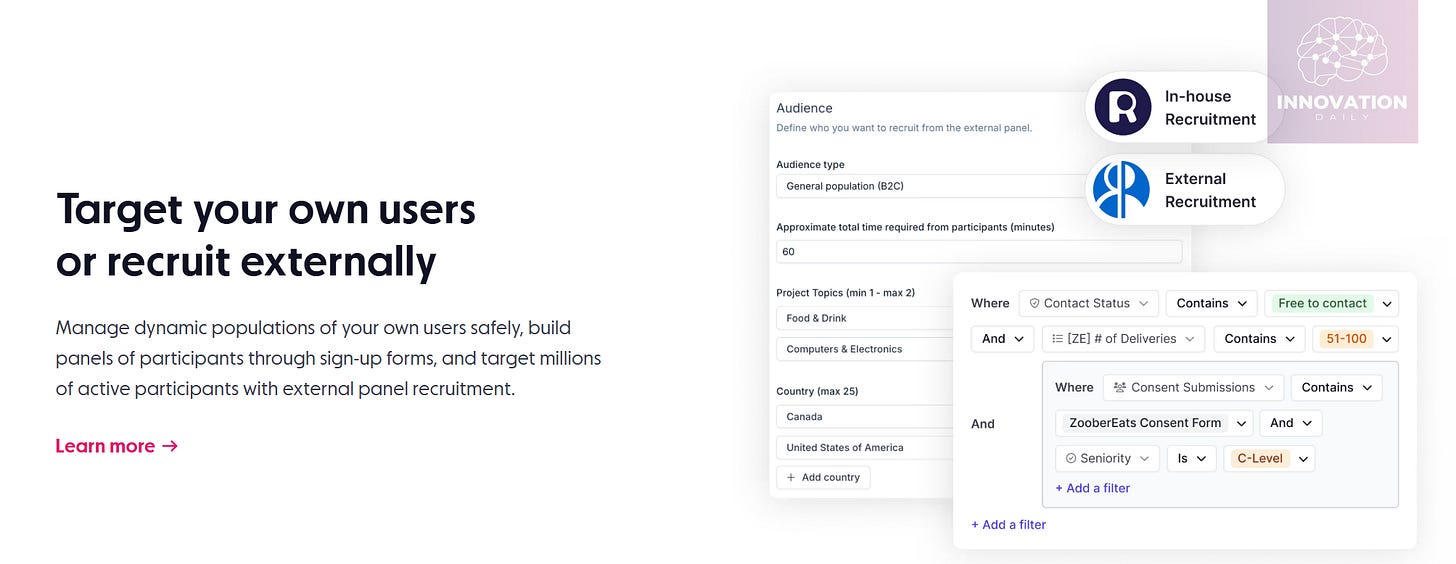

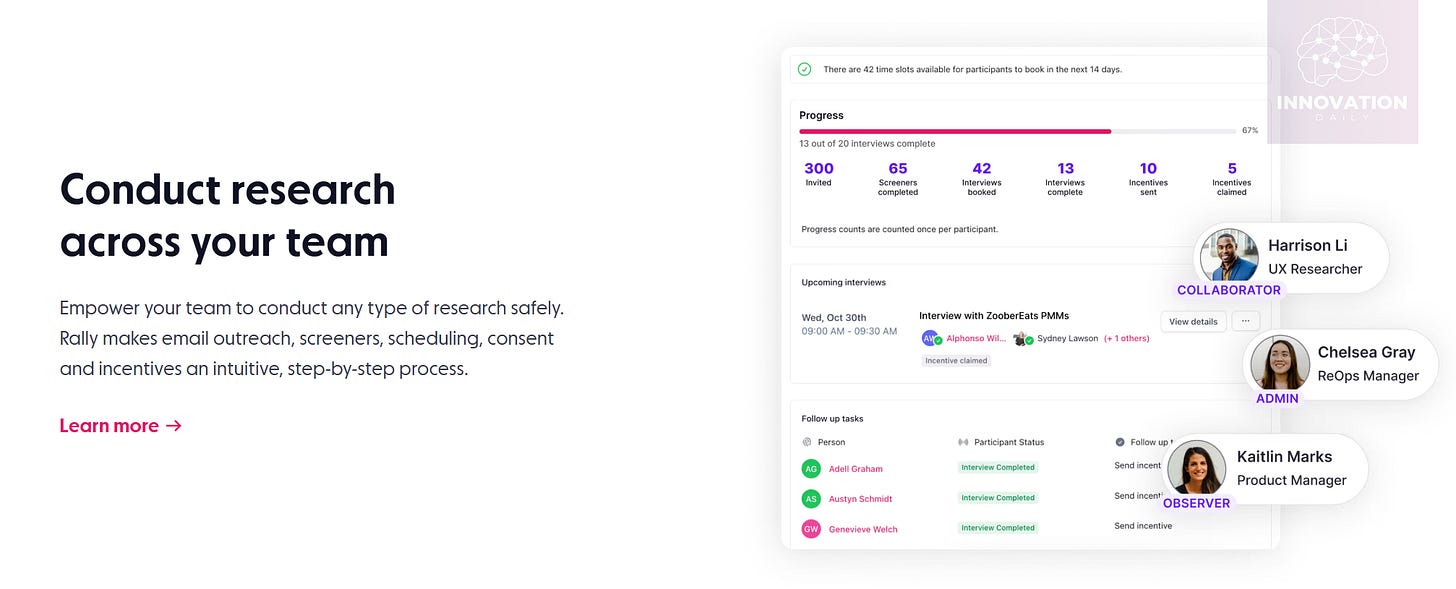

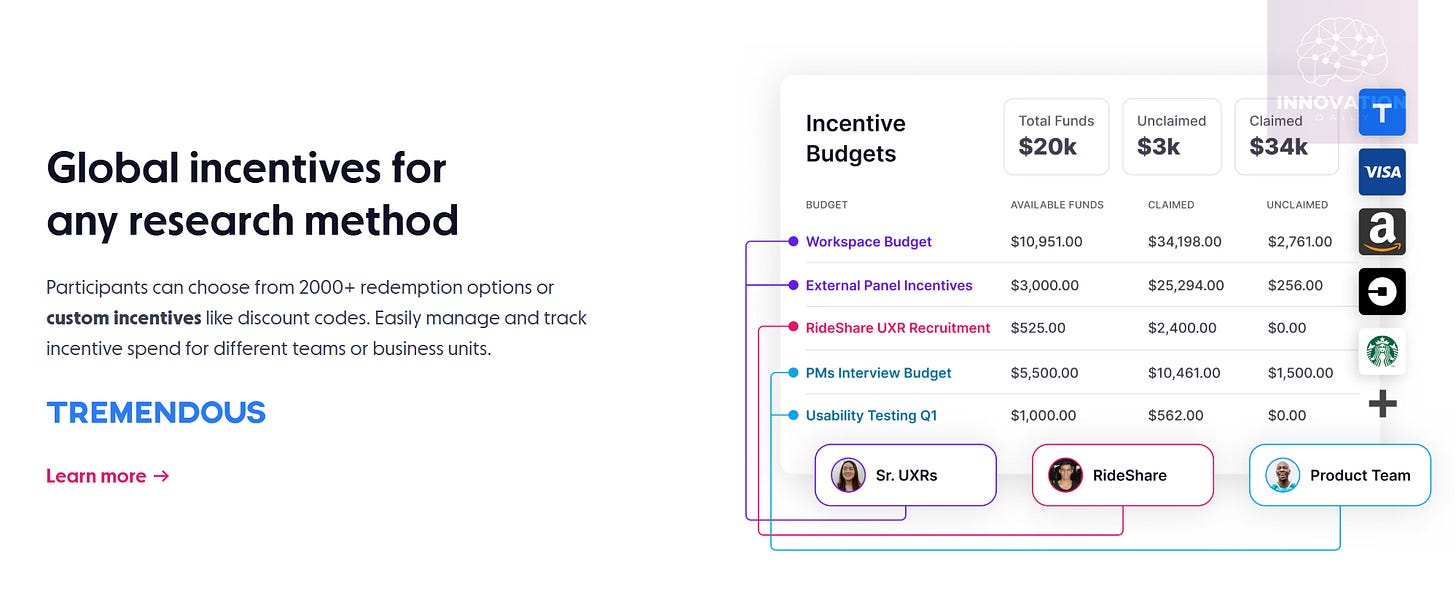

With Rally, launching a new study is as simple as defining your target user segment, setting up the schedule, and choosing participant incentives — like gift cards, discounts, or company swag. From there, Rally takes over: it automatically recruits eligible users, sends out invites, and collects responses via a custom research page.

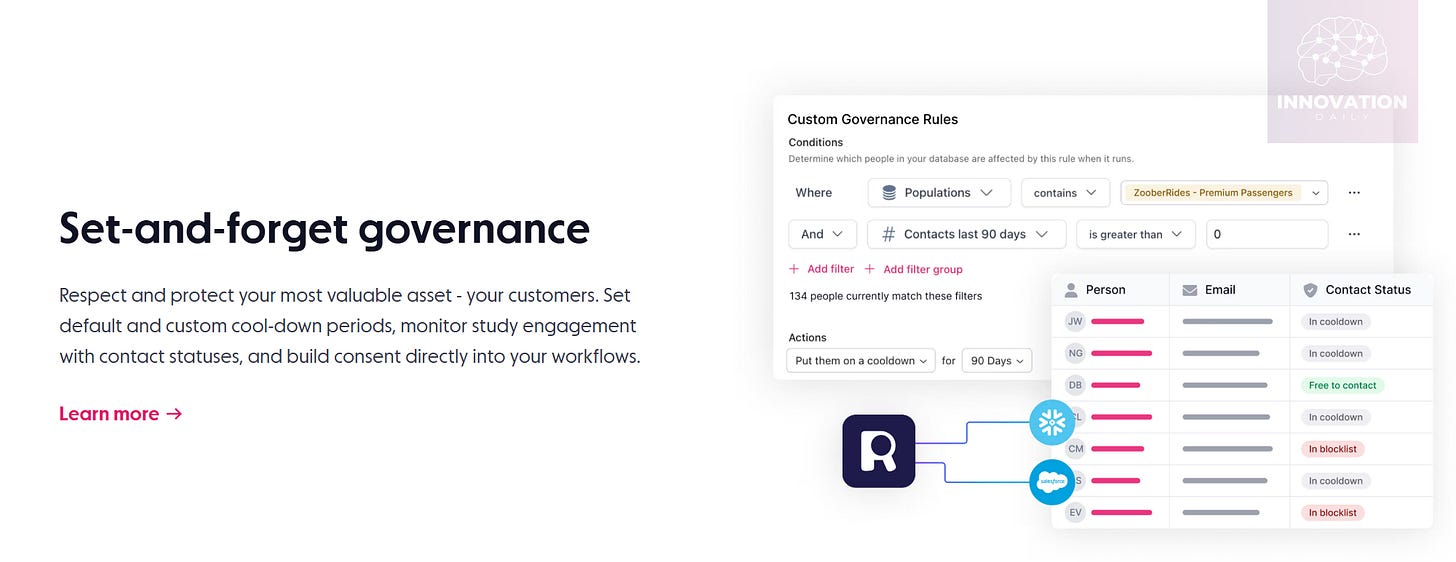

Every user has a profile within Rally’s CRM — a complete history of their participation: who responded, who ignored an invite, and how often they engage. Based on this behavior, Rally assigns statuses like “responsive,” which helps teams select the right participants for future research. You can also set “cool-down periods” to avoid over-contacting users.

One of Rally’s core strengths is enabling collaboration. Teams from different departments can contribute to the same study — shaping questions, choosing incentives, or refining the target audience — all in one place.

As a result, companies save time, reduce redundant research, and unlock insights faster. One client reported an 88% drop in time spent on research after switching to Rally.

The platform offers two tiers based on how many users can be contacted: up to 10,000 or up to 1 million. Pricing isn’t listed publicly — you’ll need to reach out to Rally directly.

Founded in 2021, Rally already counts companies like HelloFresh, GitLab, OpenTable, and Sonos among its customers. It recently raised $8.85 million in seed funding.

What’s the Gist?

Many startups obsess over surveying people who haven’t bought their product yet. “Would you buy this?” “Why haven’t you signed up?” That’s helpful, but only to a point. The most valuable insights often come from people who are already using your product — the ones you want to keep around.

That’s where Rally shines. It’s built not for cold outreach, but for deep, structured research with your actual users — people already inside your product ecosystem.

And this isn’t a niche trend. Rally is part of a broader wave of user research tools gaining traction. One notable example is Sprig, which raised $88 million. Unlike Rally, Sprig focuses on “micro-research” — asking users lightweight, contextual questions inside the product interface, based on their behavior.

For example, if a user spends too long on a certain screen, Sprig might pop up a question like “Is something unclear?” If they see a graph, it might ask “Does this make sense to you?”

Rally, by contrast, is built for more traditional user research — planned studies that take more time to set up but can go deeper. And that’s exactly why Rally’s biggest value prop is speed: cutting down that preparation time by up to 80%.

Strangely, Rally doesn’t lead with that in their messaging. Instead, they market themselves as a “modern CRM for research.” Maybe that’s because the term “CRM” has taken on a new life — no longer just “Customer Relationship Management,” but more broadly, “how your company manages any external contact.”

Take the example of Crew, a startup that calls itself a “CRM for recruiting.” Instead of managing customers, it manages communication with job candidates across departments, tracking each touchpoint just like a sales funnel. That pitch helped Crew raise $3.4 million.

So while Rally is building a CRM for user research, the bigger picture is this: we’re entering an era where more and more tools are calling themselves CRMs — not for clients, but for whoever your company needs to stay in touch with.

Key Takeaways

There are two clear directions for building in this space.

First, there’s a growing opportunity to create new platforms that help developers run structured user research. And that research doesn’t have to be just surveys or interviews. In many cases, it’s far more insightful to tweak something in the product and observe how users react — as long as those changes are targeted at small, clearly defined user segments.

One example of this kind of platform is Lancey, a Y Combinator alum building tools that enable product teams to run lightweight experiments and learn from them quickly. It’s part of a broader shift: developers and product managers want tools that make it easier to understand their users through action, not just conversation.

Second, there’s another path that’s not directly tied to user research — but follows a similar pattern. It’s the idea of building CRM-style tools for other use cases, beyond managing customer relationships.

Today, Rally is a “CRM for user research.” Crew is a “CRM for recruiting.”

So the obvious question is: what’s next? What other processes inside a company involve managing relationships with people — not necessarily customers — where a CRM-like structure could add value?

The broader trend is clear: “CRM” is becoming a flexible concept. And startups that apply this model to new domains — structuring communication, creating shared visibility across departments, and tracking long-term interactions — are likely to find strong product–market fit.

This is definitely a space worth exploring.

Company info:

Rally

Website: rallyuxr.com

Last round: $8.85M, 29.02.2024

Total funding: $8.85M+, across 2 rounds