Do What You Love — We’ll Handle the Rest”: Slingshot’s Game-Changing Offer

Most creatives dread bookkeeping and taxes, but what if they didn’t have to? Today’s featured startup is making that a reality.

Project Overview

Slingshot’s offer sounds as compelling as it gets: “Do What You Love — We’ll Handle the Rest".

However, this startup caters exclusively to musicians and other creatives. Slingshot aims to take on all the headaches related to bookkeeping and taxes — tasks that creative professionals often avoid and struggle with.

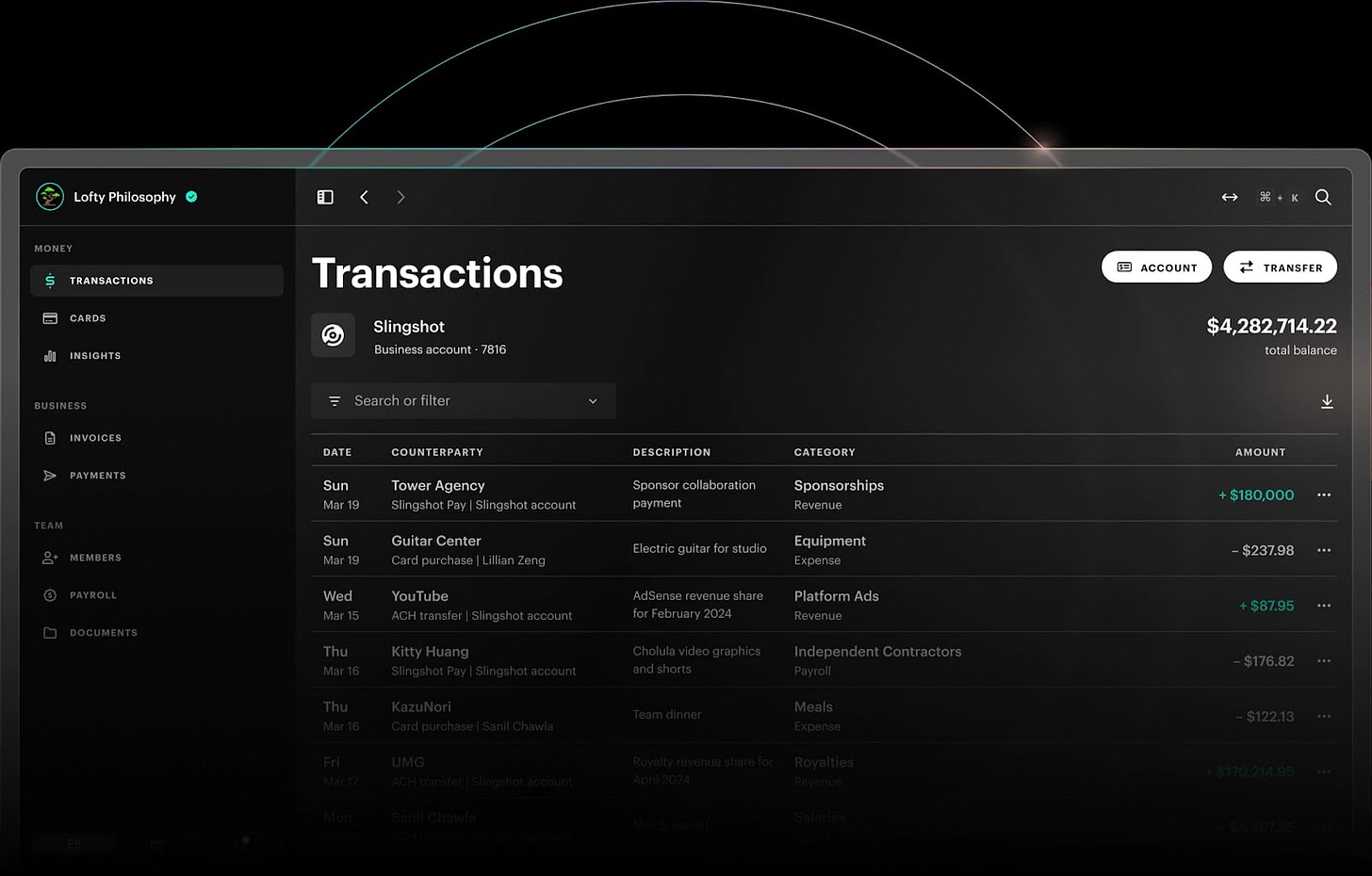

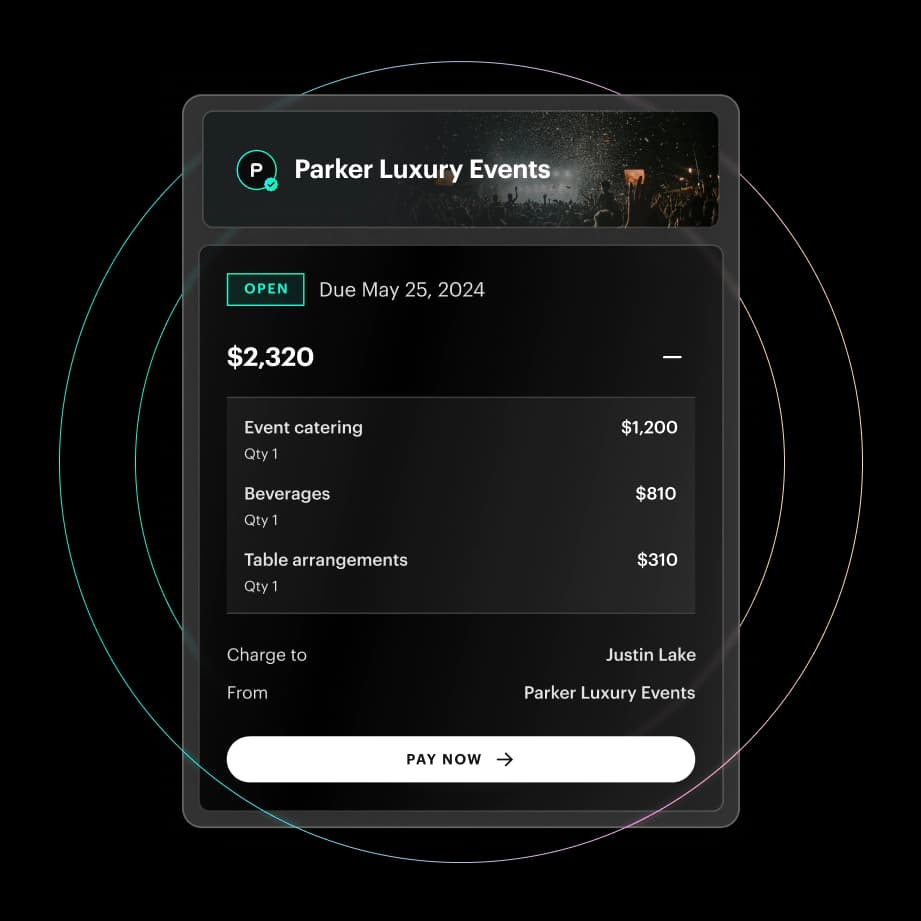

Through the Slingshot platform, users can track all their expenses, which are automatically categorized and reflected in accounting records. To receive payments, users can generate invoices or payment links directly through the platform. Funds received are also automatically categorized for accurate bookkeeping.

To get paid by clients, the platform allows users to generate invoices and payment links. Any incoming payments are automatically categorized and recorded in the accounting system for seamless bookkeeping.

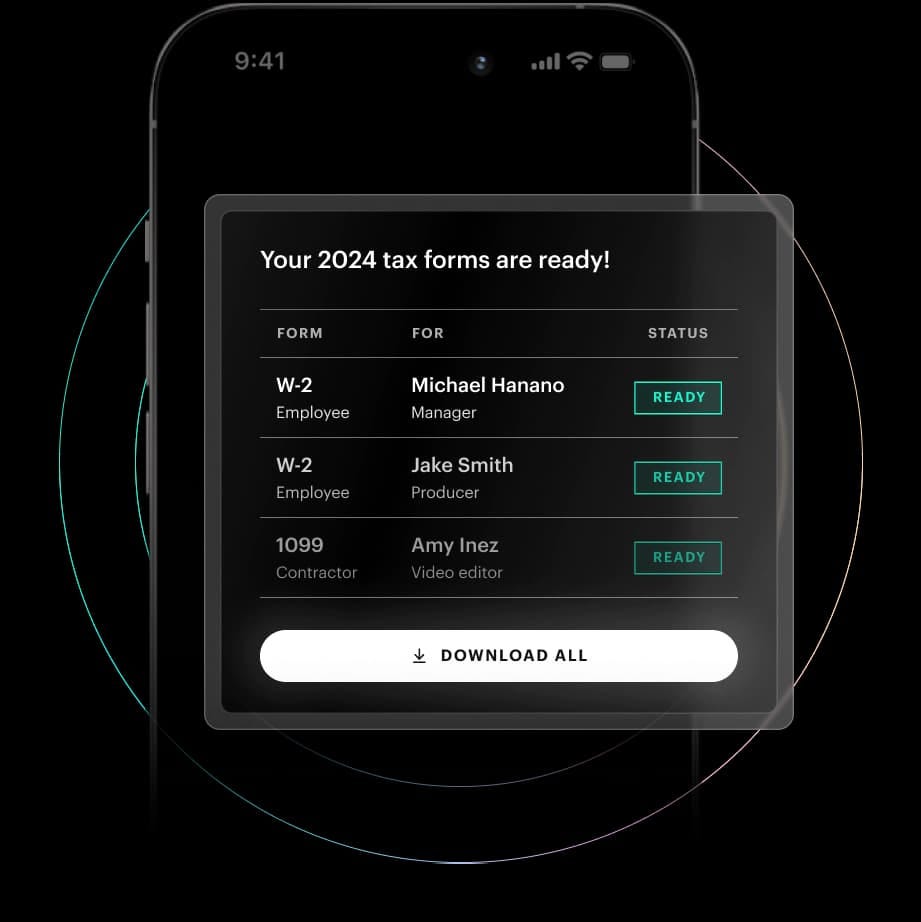

Using data on income and expenses, the platform automatically prepares and submits all necessary tax reports on time. For those with a team, employees can also be added to the platform. Slingshot then handles payroll and ensures contributions to pension and insurance funds are properly processed.

While much of the process is automated, Slingshot’s team of live experts monitors operations to ensure accuracy and makes manual adjustments when necessary. Essentially, Slingshot offers end-to-end accounting and tax management services.

But it doesn’t stop there. Clients gain access to a premium concierge service. This team can answer accounting or tax-related questions and even handle tasks like booking tickets or connecting clients with specialists for specific needs.

Slingshot prides itself on delivering tailored solutions to any problem its clients face, promising a service package that grows alongside client revenues — from $100,000 annually to $100 million.

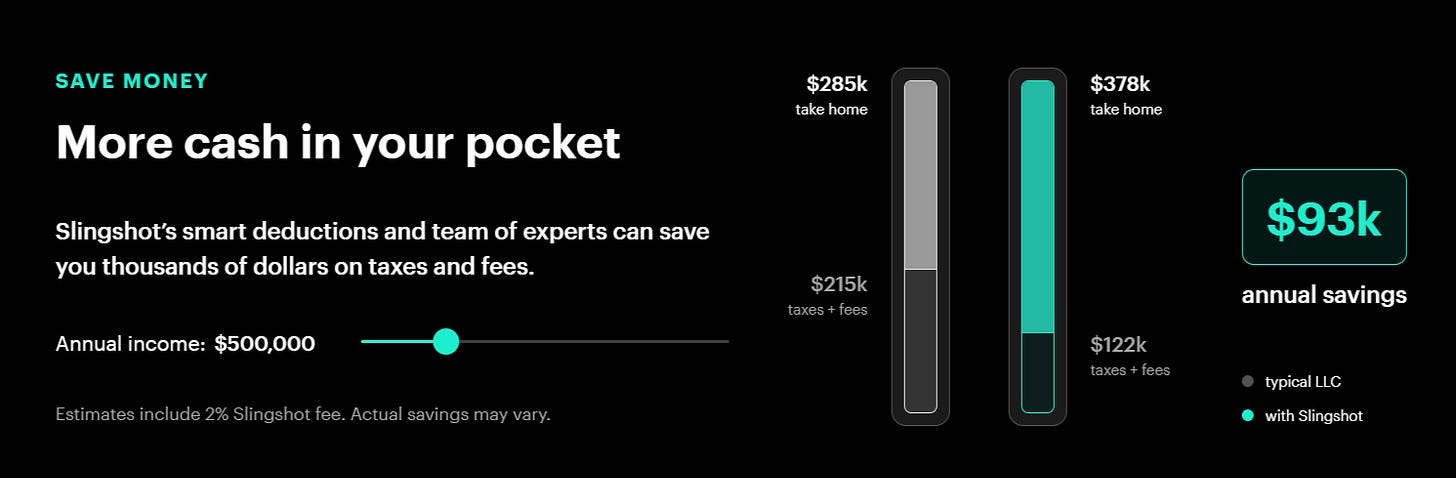

This focus on helping clients increase their earnings is more than just lip service. Slingshot charges 2% of its clients’ monthly revenue as its service fee. Despite this, clients can add an unlimited number of employees to the platform without affecting the cost.

Key Achievements and Investments

To date, Slingshot has raised $2.2 million in funding. This figure includes investments collected during the platform’s development stage.

What Makes Slingshot Unique?

It’s surprising to see a growing number of startups launching accounting and financial management platforms and attracting investment. Just a couple of weeks ago, I wrote about Layer, a startup offering an accounting platform that integrates with third-party services. A few days before that, I covered Haven, another accounting platform. Back in March, I wrote about Scaleup Finance, which provides startups with a "CFO as a Service" offering. And at the beginning of 2023, I covered Puzzle, an accounting and financial management platform.

So, today’s Slingshot is part of this somewhat unexpected trend. It could be driven by the shortage of skilled accountants in the U.S. market, as younger generations are less inclined to pursue this profession, while experienced professionals are nearing retirement. At the same time, accounting and tax regulations continue to grow more complex.

However, the real standout feature of Slingshot is its laser-focus on musicians and creatives. When they say they cater to this group, they truly do!

Accounting, financial management, bank cards, and payment processing are just the basics. Beyond that, the startup offers clients access to a fully equipped studio with $100,000 worth of instruments, documentary-style video production, performance insurance, free rentals of cameras, microphones, projectors, and other gear, plus connections to music distributors and streaming services.

The concierge team adds even more value, helping clients source video footage for music videos, license cover songs, find designers and videographers, and even handle live-streaming technical support.

At just 2% of income, Slingshot’s services are also cost-effective. For example, a musician earning $500,000 annually could save $89,000 by switching to Slingshot instead of managing their own company.

This efficiency is achieved by formalizing clients as employees or contractors of Slingshot Creative LLC, a specialized entity. Each client operates as a separate division within this company, complete with its own bank account. Slingshot’s centralized accounting team manages the finances and tax filings for all its divisions.

Industry Context

Slingshot’s pitch, “Do what you love — we’ll handle the rest,” is undeniably appealing. Would you part with 2% of your revenue for such a service?

The trend of tying service fees to the volume of transactions is already being adopted by more conventional accounting and tax platforms for small and medium-sized businesses, like the aforementioned Haven.

While ultra-low or ultra-high earners might hesitate, many others could see the value — particularly given the growing trend of accounting platforms tying fees to client revenues. Haven, for example, charges a similar model and has already achieved $1 million in annual revenue within a year, reaching operational profitability.

Bookkeeping and taxes are universally disliked yet mandatory. Startups like Slingshot are proving that these tasks are a natural starting point for building specialized services tailored to niche audiences.

Interestingly, this trend has also attracted startups that initially focused solely on banking services, such as Karat (which I reviewed), a company offering credit cards for creatives and influencers.

Today, Karat has expanded its offering to include accounting services and tax filings for its clients, in addition to hosting themed networking events. The company has raised an impressive $115.6 million in investment.

However, I believe the key to success in this space lies in narrowing down the specialization.

Take, for example, a "bank for entrepreneurs" that includes accounting and tax services. To me, this feels too broad, as different types of entrepreneurs have unique needs and challenges. On the other hand, a more specialized offering, such as a "bank for marketplace sellers," could provide tailored services like competitor monitoring, catalog distribution across marketplaces, logistics, factoring, and access to factories and suppliers. That could be the perfect fit.

What niche would you target with a Slingshot-like service? What specific set of services would you offer to that audience? And do you think Slingshot's legal structure could work in your local market?

About the Company

Slingshot

Website: slingshot.fm

Latest Round: $2.2M (May 29, 2024)

Total Funding: $2.2M (1 round)