From Fix-It Calls to Full-Time Care

Today’s featured startup is helping homeowners stay ahead of costly repairs by turning home maintenance into a proactive, AI-powered subscription service.

Project Overview

Honey Homes offers homeowners a subscription-based service for keeping their homes in shape — from routine repairs to seasonal maintenance and complex coordination tasks.

Subscribers get a dedicated home professional who visits regularly to tackle small jobs, prevent bigger issues, and even supervise external contractors for larger projects. It’s like having a reliable handyman on retainer — one who knows your home inside and out.

Each plan includes 3.5 hours of in-home service per month, plus unlimited chat support and project coordination time for more complex jobs.

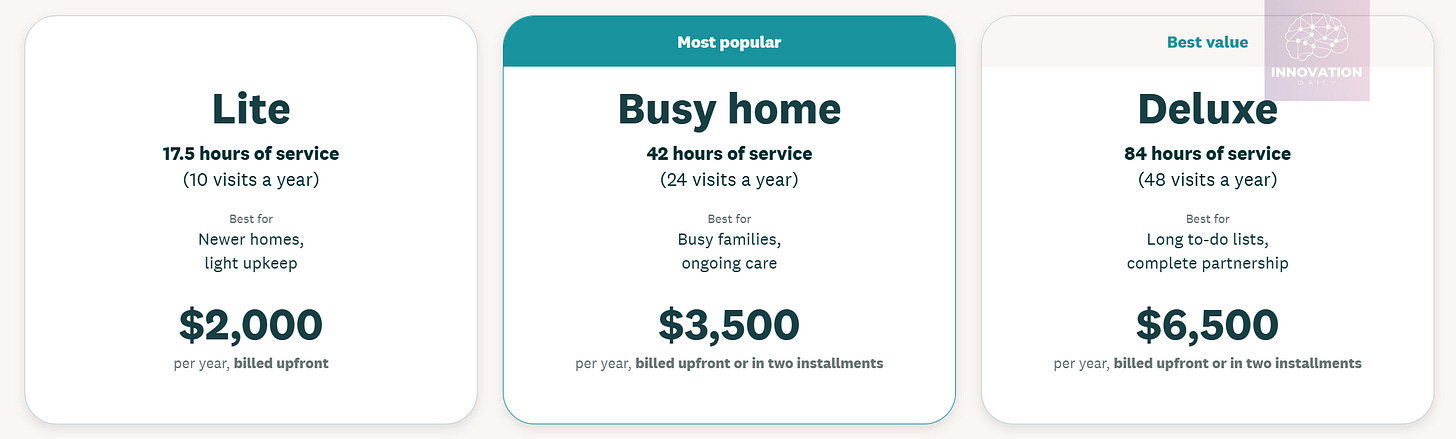

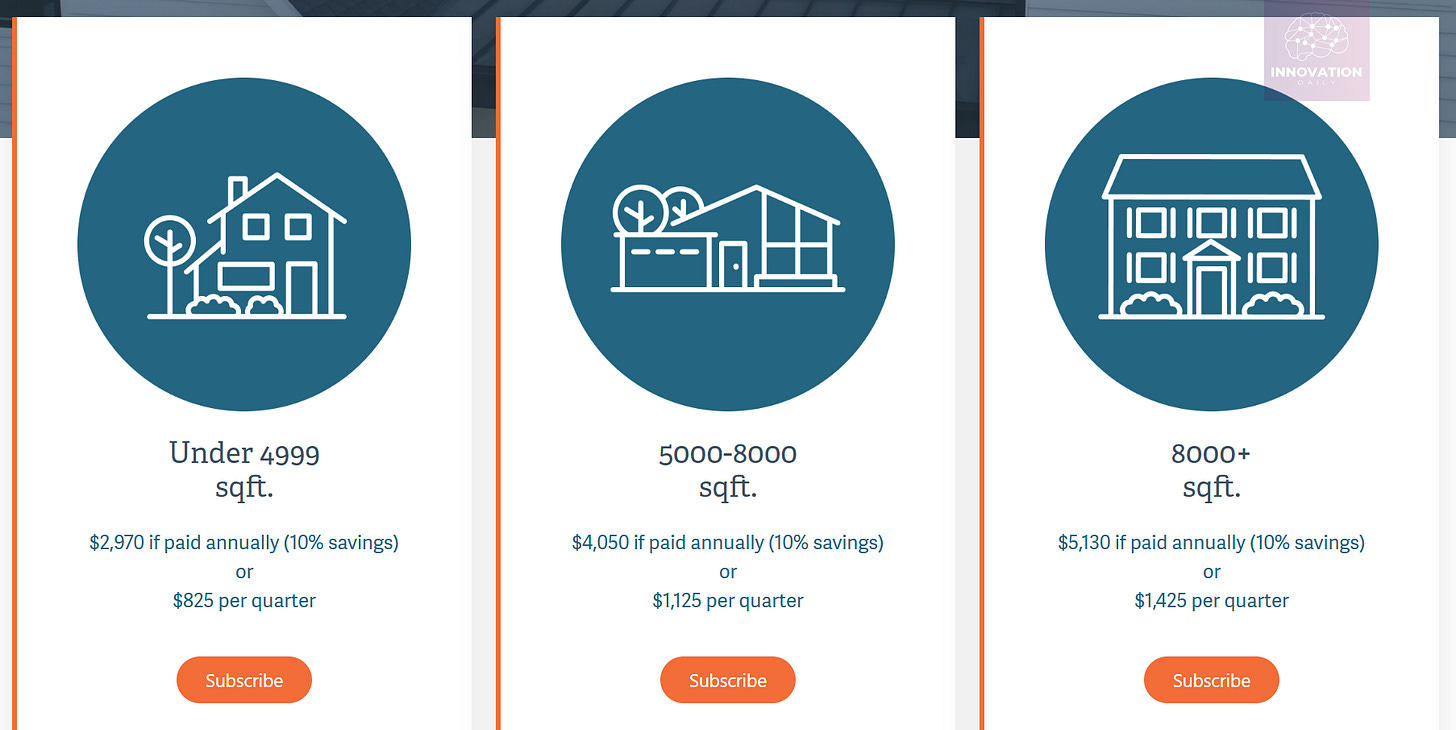

Honey Homes now offers three membership tiers:

Lite – $2,000/year

Busy Home (most popular) – $3,500/year

Deluxe – $6,500/year

Launched in 2021, Honey Homes now serves over 2,000 paying subscribers and has raised $21.4M in total funding, including a recent $9.25M round. The company’s annual revenue grew 3.6x in 2023.

What’s the Gist?

Honey Homes solves three major homeowner pain points:

Quick fixes — unclogging drains, hanging TVs, patching walls, fixing switches.

Preventive care — replacing AC filters, flushing washing machines, cleaning vents.

Project oversight — supervising painters, roofers, or seasonal decorators.

Each home is assigned a dedicated technician, who gets familiar with the property over time. These techs are full-time employees with salaries, benefits, and long-term commitment — which creates both trust and accountability.

Scheduling is done via app: customers log tasks, and when the list is long enough, they book a visit.

The base plan includes 3.5 hours/month of on-site work, plus unlimited chat support and project coordination.

💡 New twist: Honey Homes recently introduced an AI-powered maintenance scheduler, which uses aggregated data to predict when home systems (like HVAC or plumbing) typically fail — and preemptively adds tasks to the customer’s to-do list.

This shift from repair to prevention reflects a broader trend in home services:

“Get paid to keep things working — not to fix them when they break.”

Several startups are exploring this logic from different angles:

Scription — builds a partner network of local home service providers powered by their SaaS platform (raised $6.3M)

Pipedreams — acquires traditional repair businesses and moves them to a modern IT stack ($35.7M raised)

Super — positions itself as an insurance company for your home systems, selling protection plans and proactive service ($79.6M raised)

HomePoint — similar to Honey Homes, but targets luxury properties (starting from 8,000 sq ft), currently operating in Austin with $2M in funding

Even a quick Google search reveals more players entering the subscription-based home repair space — from Hello Handy and Hearth & Home, to Latitude, Home Stewards, and others. Most emphasize preventive maintenance to avoid costly future breakdowns.

Key Takeaways

The home maintenance subscription model is clearly gaining traction. A simple Google search for “home maintenance subscription” returns a wave of startups offering similar value props. But here’s what matters:

It’s a big market, and the subscription format is no longer exotic.

Most competitors are local — which opens space for a national player.

Honey Homes aims to be that player, by building its own network of W2-employed technicians, coordinated through a centralized IT platform.

Just like McDonald’s scaled not by serving the best burgers but by ensuring consistent quality across thousands of locations, Honey Homes isn’t trying to be artisanal. It’s building infrastructure for predictable, scalable service.

Three main strategies are emerging:

SaaS Layer (Scription) — license your tech to local players

Roll-Up Model (Pipedreams) — buy and digitize them

Owned Ops (Honey Homes) — hire your own crew, own the full experience

Which would you choose — and what’s your first move?

Company Info

Honey Homes

Website: honeyhomes.com

Last round: $9.25M, 15.05.2024

Total Investment: $21.4M across 4 rounds