How to Gain 100,000 Customers Without Breaking a Sweat

In today's world, finding warm customers can be a real challenge. This startup has found a way to bypass the struggle

Project Overview

Layer is a regular platform where sole proprietors and small businesses can manage their accounting. However, it spreads in an unconventional way!

The startup has created an "embedded" accounting system. The Layer platform can be integrated by developers of vertical (niche) cloud services for small businesses, allowing their clients to manage accounting directly within the service's dashboard.

Thus, a developer of a salon management system can embed accounting for salons, a developer of an online kitchen ordering system can embed accounting for dark kitchens, and so on.

The key feature is that each accounting system will be pre-configured to make bookkeeping easier for that specific type of business. Additionally, all transactions carried out within the particular cloud service will automatically be added to the accounting system and processed accordingly.

If a client company of the cloud service performs other operations outside of the service, it can integrate other sources of its financial information into the built-in accounting system — such as bank accounts via Plaid, payment operators like Stripe, other online food ordering systems like Gusto, and so on. This way, the integrated accounting system will start tracking transactions that occur both within the service and externally.

If service clients want not just an accounting platform to manage themselves, but a complete end-to-end accounting and tax filing service, Layer offers this as an additional service, provided by specialists based on the primary data accumulated within the accounting platform.

Layer also offers services for migrating existing accounting systems from popular platforms like QuickBooks to the Layer platform.

Naturally, the service that integrates the Layer accounting platform or offers accounting services from Layer will charge its clients additional fees for these services, sharing the revenue with Layer.

This allows cloud service developers to earn extra income from their existing client base. Additionally, developers gain a "second rope" beyond their product's core functionality, strengthening client retention and engagement.

Embedding Layer's accounting system into a cloud service is not a particularly complex task. Developers only need to integrate Layer’s API calls into their system to reflect the operations performed within the service and display the accounting interface.

Layer was founded in 2023, and its platform has already been integrated by four cloud service developers, whose clients include around 100,000 small businesses.

Currently, Layer has raised its first $2.3 million in investments.

What's interesting:

Take note of the statement in the previous section that Layer’s platform has been integrated by four developers, whose clients include around 100,000 small businesses.

In other words, Layer spent time targeting just four companies, which automatically brought them 100,000 warm leads. How much time and money would they have needed to acquire 100,000 warm leads directly? It’s almost impossible to imagine.

It’s no coincidence that renowned venture capitalist Peter Thiel asserts, "Distribution must be built into the architecture of the product itself. If you've created a new product but haven't figured out an effective way to distribute it, you’ll have a bad business, no matter how good the product is. A great distribution and sales system can create a monopoly, even if the product is indistinguishable from others. The reverse is not true."

Today’s Layer follows this exact advice. Their accounting platform may not be any better than any other accounting platform out there. But they’ve figured out how to distribute it effectively.

In recent times, new accounting platforms have been emerging and raising investments at a rapid pace. Just three days ago, I wrote about the accounting platform Haven, and earlier in 2023, I covered Puzzle, which raised $15.3 million.

It’s worth noting that in addition to accounting, Puzzle allows users to manage financial records — building business financial models, calculating metrics, and creating reports and forecasts for existing shareholders and potential investors.

That's why the startup Scaleup Finance, which I wrote about in March, has taken it even further. It offers a "finance director as a service" solution, which includes outsourcing accounting, building financial models, and handling other tasks typically performed by a financial director, who should not be confused with a chief accountant. This startup has raised $25.6 million in investments.

It seems like there is a trend emerging towards the next generation of accounting platforms. Older platforms like 1C or QuickBooks may be replaced by new ones — those that are more modern, lightweight, incorporate new AI technologies, and also include financial accounting and management elements.

This is definitely possible if the focus shifts from "switching" old companies to new accounting platforms to "introducing" them to new companies. After all, new businesses are constantly emerging, with over 5 million new companies registered annually in the U.S. These startups are much more likely to adopt new solutions since they aren't yet deeply entrenched in legacy systems.

Following Peter Thiel's logic, the winners in this generational shift won't necessarily be those with the best product, but those who build the best distribution system. And that's exactly what today's Layer is positioning itself to do.

But how willing will developers of vertical SaaS and marketplace platforms be to integrate accounting systems into their services? Without their strong motivation to do so, this well-designed distribution scheme won't work.

In 2020, the well-known venture fund a16z noticed a trend that financial services are a great way for vertical services to scale. Vertical services can offer their clients additional financial services from themselves or their partners, such as loans, and earn well from this.

As evidence of this thesis, consider the example of Shopify, which earned "only" $444 million in subscription fees for its online store builder in Q2 2022, while earning $1.3 billion from financial services (payment fees, loans to merchants, etc.)!

Vertical services can infer the financial health of their users (such as how often they buy from a specific seller) and when they may need money (because a large order has gone through their service). As a result, these services can acquire customers for financial products much faster and cheaper than any third-party financial company, which would have to rely on mass advertising and spam to find even a few legitimate customers who need money right now.

The key phrase here is "by indirect signs." While this is certainly better than nothing, it's still not as good as using "reliable information."

So, where can vertical services obtain this reliable information? From the user's accounting records, if they start managing their accounts directly within the service. And that’s exactly what today’s Layer offers to vertical services! This creates a strong incentive for them to adopt it, which means this distribution scheme could very well work.

Where to go from here:

If there is indeed a generational shift underway in accounting platforms, the first direction to move in is creating these new accounting platforms.

One can endlessly discuss the new features and qualities such a platform should have. However, if we don't immediately incorporate a distribution mechanism into the platform's architecture, all these discussions may lead to nothing. Therefore, one of the paths is to follow the example set by today's Layer and create not just a "new" accounting platform, but a new accounting system that can be integrated into third-party B2B services. The focus should be on figuring out how to effectively sell this accounting system to the developers of these services so they, in turn, can effectively sell it to their users.

If you're developing a vertical B2B service, the direction you must move in is integrating additional financial services into your platform, which will help you scale more effectively.

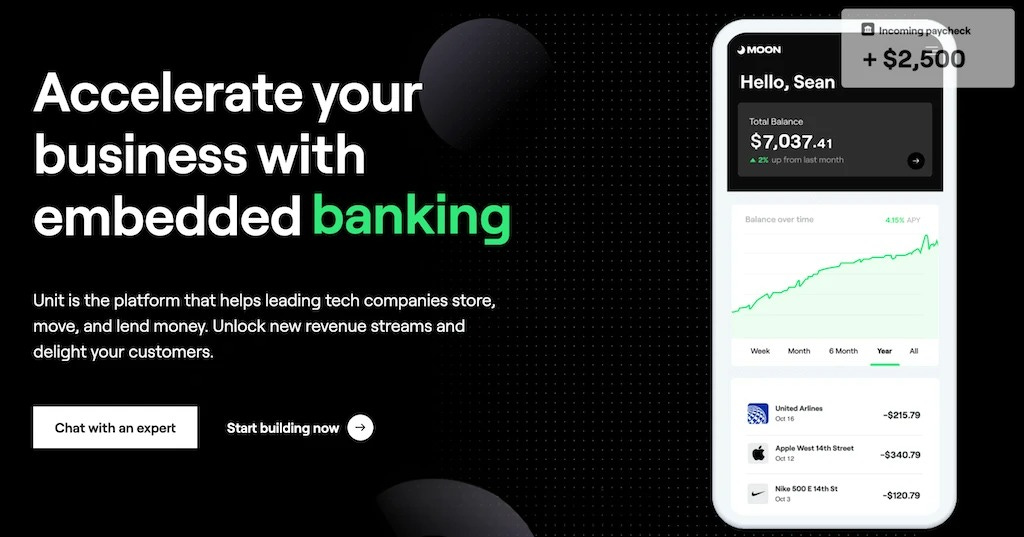

There are already enough intermediary platforms that attract financial partners and, on the other hand, provide APIs for integrating those partners' financial services into your products.

For example, consider Unit (my review), which has raised $169.6 million in investments, $100 million of which came after my review. Or Qover (my review), specializing in embedded insurance services, which has raised $71.7 million, with $30 million raised after my review.

In the world of vertical cloud services, you either integrate financial services to embed in third-party platforms or you embed them into your own. There is no third option.

Which path will you take?

About the company

Layer

Website: layerfi.com

Latest round: $2.3M, May 15, 2024

Total investments: $2.3M, rounds: 1