Know Your Enemy

Today's featured startup is trying to marry private equity with AI.

Project Overview

Everyone is familiar with venture capital funds that invest in startups. These funds profit from the increasing value of private companies—either when they are acquired for substantial sums or when they go public, allowing investors to freely sell their shares.

However, there is another type of investment firm: private equity (PE) funds. These funds also invest in private companies, sometimes acquiring them entirely—but not with the intent to sell. Instead, they aim to generate long-term profits through dividends from the company’s ongoing operations.

As a result, private equity funds face two key challenges. First, they need to identify profitable companies with long-term growth potential. Second, they must find reliable executives who can drive these companies’ profitability after an acquisition or investment.

Verata positions itself as the solution to both challenges by “combining LinkedIn and PitchBook” into a single platform, making it easier for private equity funds to conduct research and make informed investment decisions.

Currently, PE funds rely on multiple sources of information. They use PitchBook to track investment history, ZoomInfo for revenue estimates, and LinkedIn to research current executives and potential hires. After compiling this data into spreadsheets, they still need to verify and refine it through calls and emails, a process that is both time-consuming and inefficient.

Verata’s core innovation is its AI-powered revenue estimation engine, which gathers indirect data from the internet and other public sources. This AI continuously updates revenue estimates, allowing users to track trends and market dynamics over time.

The immediate benefit is the ability to quickly identify high-growth companies in a given sector and compare them to competitors. This enables investors to create a shortlist of potential acquisition or investment targets for further due diligence.

The second, more intriguing benefit is the ability to assess executives based on their track records. By linking executive resumes with revenue data from the companies they’ve managed, Verata can reveal who successfully grew revenue and who underperformed.

Since market conditions vary, Verata doesn’t just analyze absolute performance—it also provides relative comparisons. This means investors can evaluate an executive’s impact not just in isolation but against industry benchmarks at the same point in time.

This approach provides far more valuable insights than a traditional resume, as it allows private equity firms to make data-driven predictions about how an executive might influence a future portfolio company’s financial performance.

Verata’s AI achieves 85% accuracy in revenue estimation, and its database includes over 300,000 executives from private companies. As a result, PE funds can accelerate their investment research process by nearly five times—while simultaneously identifying top leadership candidates for acquired companies.

Verata participated in Y Combinator in 2023 and has been refining its platform since then. The startup recently announced the launch of its latest version on Y Combinator’s website just two days ago.

What’s the Gist?

The use of AI for competitive intelligence is a growing trend, with multiple startups emerging in this space.

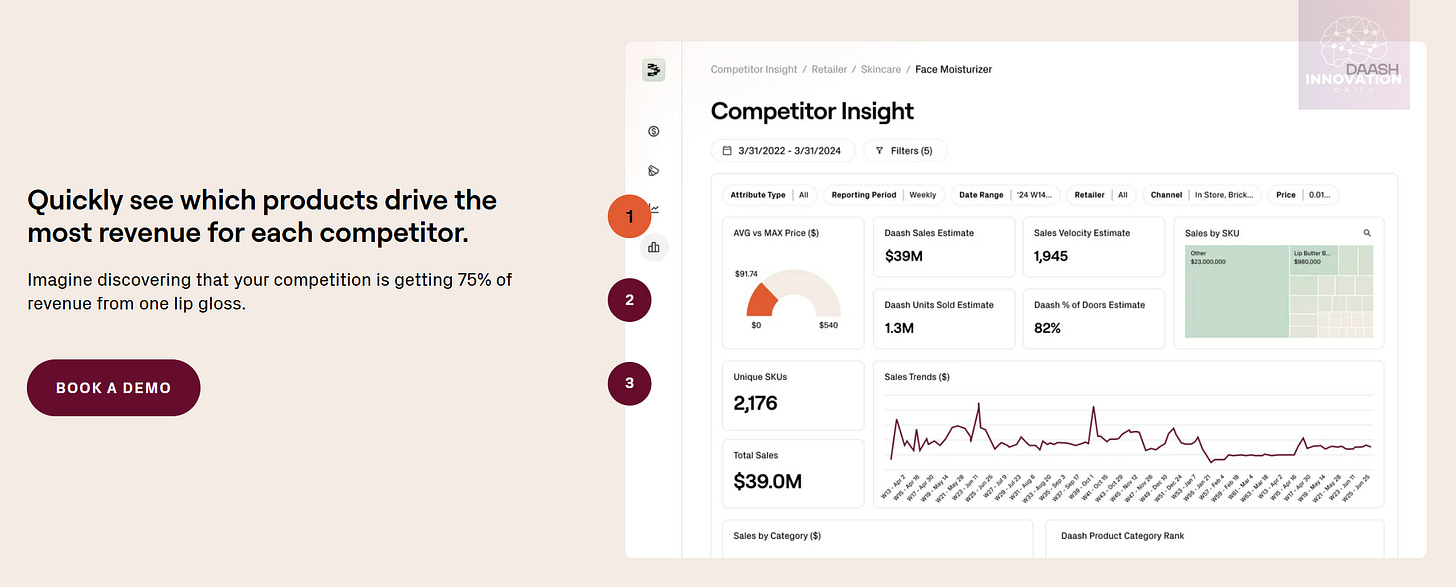

For example, Daash recently raised $8.3 million for a platform that helps beauty and personal care brands monitor their competitors.

The first level of Daash’s analysis provides general revenue insights, similar to Verata’s approach, but incorporates consumer survey data to refine estimates.

The second level identifies which specific competitor products are performing best—not just by total revenue but also by growth rate, helping brands spot rising stars they may want to replicate.

The third level analyzes which product attributes drive revenue most effectively. These could include specific ingredients or marketing keywords that resonate with consumers. This data allows companies to develop new products with similar attributes, leveraging the same “magic words” in their marketing.

Daash’s strength lies in combining revenue estimates with detailed product data, making its platform particularly valuable to industry-specific clients. This specialization gives it the potential to become the de facto standard for competitive intelligence in the beauty industry.

Similarly, Verata isn’t just aggregating revenue data—it’s integrating it with executive performance analytics. This differentiation increases its value as a private equity research tool and enhances its chances of becoming the industry standard.

Key Takeaways

One promising direction for AI-driven startups is the creation of competitive intelligence platforms.

The core of any such platform must be an AI engine that estimates competitor revenues. However, rather than attempting to build a universal platform for all industries, a more strategic approach is to develop specialized solutions for specific verticals. This requires gathering additional, industry-specific data to enhance the platform’s value.

While this approach may be more complex, it provides a stronger foothold in niche markets—creating defensibility against generic, one-size-fits-all solutions.

Another intriguing opportunity is enhancing candidate resumes with measurable performance data. This would help companies make more informed hiring decisions.

Verata enriches executive resumes with revenue growth data. But similar approaches could be applied in other fields. For example, an AI platform could analyze social media managers by correlating their past roles with audience engagement growth on their employers’ social media pages. This type of insight could be invaluable for recruiting or poaching top talent in the field.

What other professions could benefit from AI-driven performance analysis? Identifying these opportunities could lead to the next breakthrough in AI-powered hiring platforms.

Company Info:

Verata

Website: veratainsight.com

Total investment: $500K, round: 1