Money, Scale, and Prospects

A revolution in the UK home daycare market: This startup is digitizing the industry with an app that streamlines operations for caregivers and connects them to parents.

Project Overview

In the UK, the term "childminder" refers to individuals who run home-based daycare services — entrepreneurs who have obtained permission to care for other people's children in their own homes.

Sometimes, people start this business because they are already taking care of their own children of similar age, as adding a few more children doesn't drastically change the situation. This also provides them with an opportunity for additional income.

Tiney, although calling itself a "community," is officially an agency licensed to train, support, and ensure the quality of the work of these childcare entrepreneurs.

The main feature of Tiney is that it transforms home-based daycare services into a digital business — offering caregivers and parents an app that enables them to manage everything needed for this type of business.

In the app, caregivers maintain a "log" of daily activities in the daycare. They write posts, share photos, and videos — all of which parents can view in a format similar to Instagram.

Naturally, there's also a chat feature, where caregivers can communicate with parents via private messages or post public announcements for all parents.

Through the app, parents can reserve days and hours for their children at the daycare and sign the corresponding contracts, while caregivers can issue invoices for their services.

Parents can also pay invoices through the app. All this information is stored in the service, allowing caregivers to submit income declarations to the tax authorities directly through the app.

A dedicated section of the app for caregivers includes training courses and useful tips to help them perform their job more effectively.

The Tiney website and app feature a marketplace where parents can find home-based childcare providers, whose creators are partners of Tiney.

Tiney currently has 5,484 home-based childcare providers as partners, catering to 4,449 children. These nurseries are operated by over 1,000 entrepreneurs, 537 of whom joined the service in 2023.

Tiney has achieved a parent satisfaction rating of 9.8 out of 10. Among the most valued features by parents are the daily digital child observation journal and the ability to reserve and pay for childcare services through the app.

Recently, Tiney raised £7.2 million (approximately $9.1 million), bringing the total investment in the project to £19 million.

What’s interesting:

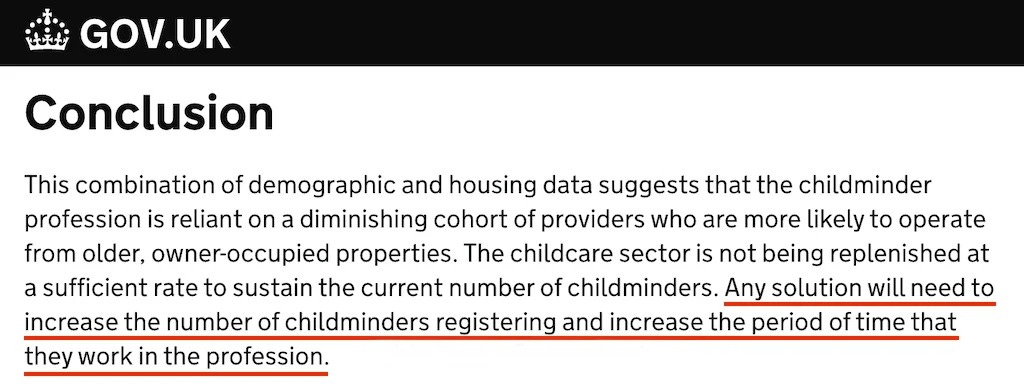

Tiney’s growth is occurring against the backdrop of a steady decline in the number of home-based childcare providers in the UK. In the 2012-2013 period, there were over 55,000 such providers, but by 2022-2023, this number had dropped to less than 30,000. This decline is largely due to the increasing organizational and reporting burdens faced by childcare providers, which they often struggle to manage effectively on their own.

The UK government is sounding the alarm, stating that "any solutions that help increase the number of home-based childcare providers and extend the time they remain in the profession" are urgently needed. And services like Tiney could play a significant role in addressing this issue.

However, the most interesting aspect isn't even the home-based childcare providers in the UK. It's the two other important trends that are not only visible in the case of Tiney but are also emerging in other thematic and geographical markets.

Take, for example, veterinary clinics in the United States. Veterinarians in the U.S. are mostly individual entrepreneurs or small businesses, as is often the case in almost any service industry.

However, there is a sharp shortage of veterinarians due to the fact that the number of pets in American households is growing at a faster rate than the number of new professionals entering the field. By 2030, the market will need an additional 41,000 veterinarians, with a clear shortage of 15,000 professionals.

This is where platforms like Digitail come into play, aimed at digitizing the work of veterinarian entrepreneurs. I wrote about it early last year. This platform helps veterinarians save time on patient appointments and reduce "excess" paperwork, allowing them to serve more clients. The startup raised $14.7 million in investments.

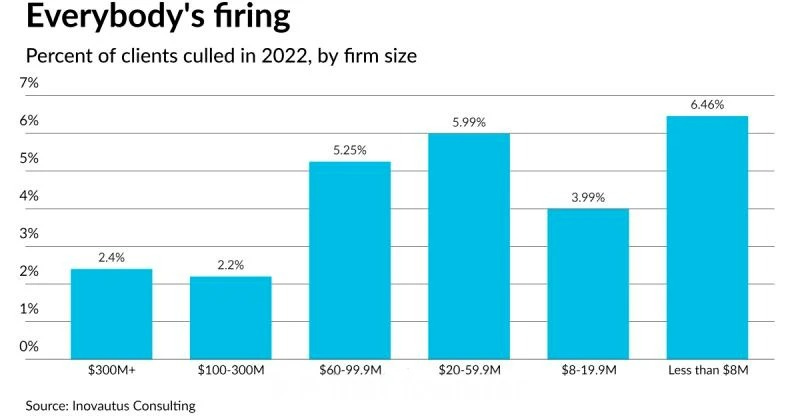

Or let's take accounting firms in the same U.S. market. The older professionals in this field are retiring, while new people are reluctant to enter the profession.

This creates an imbalance between supply and demand in the market, forcing accounting firms to even start turning away clients. The smaller the company, the more often such refusals occur.

This is why startups like Basis have emerged, which I wrote about last autumn. This startup developed an AI assistant for accounting firms, enabling them to handle more clients with fewer employees. The startup raised $3.6 million in investments even before launching their product.

Thus, the first trend is the accelerated digitalization of service sectors where demand outpaces supply.

These are typically fields where there is a lack of influx of new professionals, as the younger generation views these careers as too conservative. This leads to an interesting paradox — digitalization is progressing faster in less technologically advanced sectors, not the more tech-savvy ones. This is happening because without digital transformation, these industries simply won't survive.

When we onboard these "underdeveloped" companies onto our digital platform, which manages all of their processes and financial flows, we essentially gain the ability to control the quality of their operations and monitor their cash flow. This provides us with the opportunity to take our share through subscription fees and/or a small percentage of their revenue.

In this way, we create a model that I have previously described as a "franchise without the franchise." It follows the business model of a franchise, but without the formalities like requiring companies to rebrand or perform other ritualistic actions.

A good example of this model is Tiney. While they refer to their clients — the childcare providers — not as "franchisees," but as "community members," they are essentially operating under the same principle.

A similar model is used by the startup Platform Accounting Group, which I wrote about in February. They created a platform to improve the efficiency of small, local accounting firms — and raised $85 million for this purpose.

The large investment is also driven by the startup's goal of acquiring the most promising partner companies. The attractiveness of these companies is determined by the activity and the flow of money passing through their platform.

The startup Pipedreams, which I wrote about in March, is digitizing the outdated field of HVAC (heating, ventilation, and air conditioning) installation and servicing — by integrating their platform into these companies.

However, they first acquire these companies and then proceed to digitize them. They raised $35.7 million in investments and stated that this will be their final equity funding round, as they plan to rely on debt financing going forward, which they believe will be sufficient.

The startup Moxie, which I wrote about last summer, helps nurses and doctors set up their own cosmetic treatment practices, which they can manage through the Moxie platform. The startup emphasizes that each practice is an independent business, not part of a large franchise. Moxie raised $15.7 million in investments for this.

Where to go from here

The overall direction of potential growth lies in creating digital platforms for "outdated" service sectors that people, however, cannot do without.

The first advantage of this direction is that not many startups are looking into it, as these sectors are neither new nor particularly "sexy."

Therefore, there may be significantly fewer competitors in this space compared to more popular sectors among startups.

The second advantage is that the primary task of these platforms is not even client acquisition, because in these sectors, demand usually exceeds supply. Instead, the main goals are: a) saving time on client servicing and b) improving the predictability of service quality, which helps attract and retain customers. These two tasks are much more important than constantly searching the market for new clients for your partners.

The third advantage is that such digitalization opens up a much broader and more profitable range of opportunities than simply selling the platform. At a minimum, you can implement the "franchise without the franchise" model, taking a share of the earnings generated by your partners. At most, you can also buy out promising partners, the potential of which you can monitor through the very same platform.

Additionally, earning from areas where demand has already been proven is much easier and faster than coming up with and testing hypotheses about the existence of new demand.

So, which "outdated" service sector will you be able and willing to enter with your digital platform?

One example of such a sector could be elderly care, as the proportion of elderly people in the global population has been rising sharply due to increased life expectancy. However, finding a reliable caregiver for elderly parents is a serious challenge.

About the Company

Tiney

Website: tiney.co

Latest round: £7.2M, May 13, 2024

Total investments: £19M, 3 rounds