Startup Spotlight #20: Do What You Love

Today's featured startup promises to handle the rest.

Project Overview

“Do what you love. We’ll handle the rest.” — Slingshot’s promise is undeniably appealing, regardless of what you do in life.

For better or worse, however, this startup caters exclusively to musicians and other creatives, offering to take over the headache of bookkeeping and taxes — tasks that creative individuals generally dislike and often lack the expertise to handle.

On the Slingshot platform, users can track all their expenses, which are automatically categorized and processed into the necessary accounting entries.

To receive payments from clients, users can generate invoices and payment links directly through the platform. Funds received this way are also automatically categorized and reflected in the bookkeeping system.

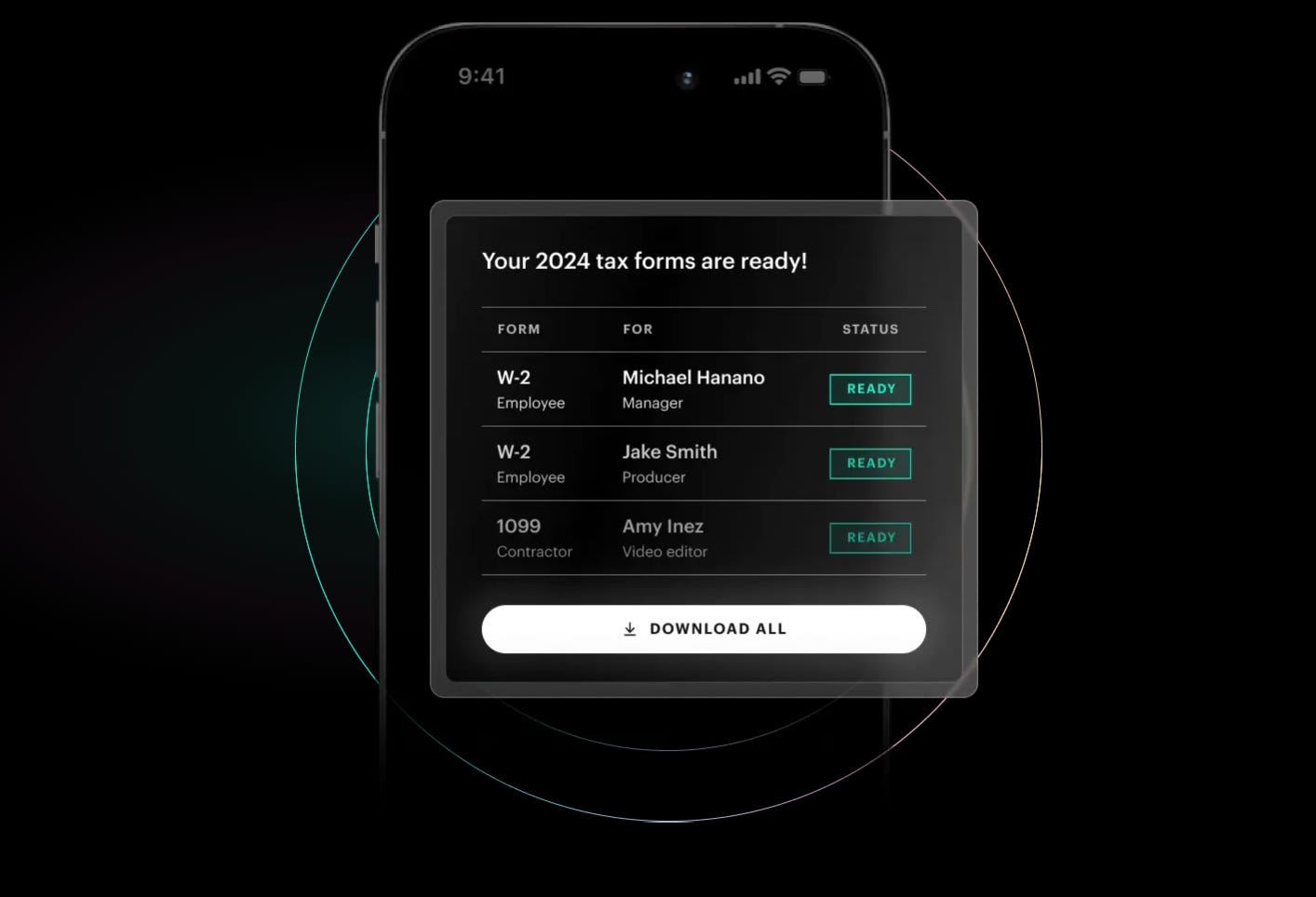

Using income and expense data, the platform generates all required tax filings accurately and on time.

For creatives working with a team, the platform allows for adding employees. In such cases, Slingshot handles payroll, including contributions to pension and insurance funds.

While most of this work is automated, Slingshot’s team of specialists ensures the automation runs smoothly, stepping in to manually correct or complete tasks when needed. Essentially, the startup offers a turnkey accounting and tax reporting solution.

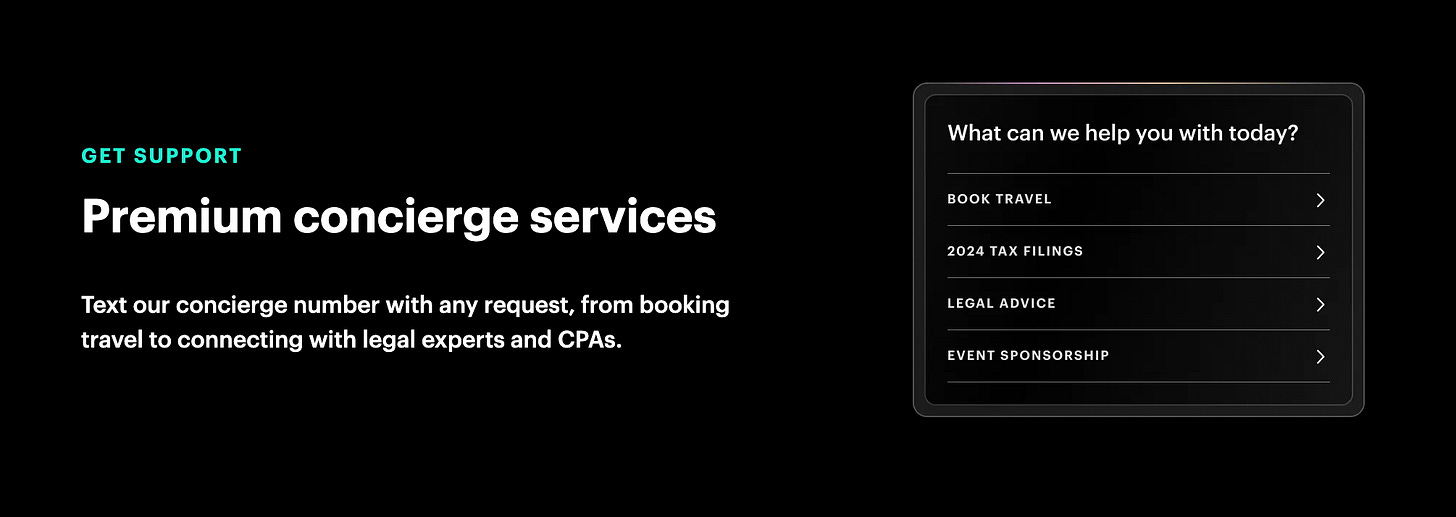

Beyond the bookkeeping platform, Slingshot also provides a premium concierge service. Clients can ask questions about their accounting and taxes or request specific tasks, such as booking travel or connecting with specialized professionals.

The startup claims to deliver tailored solutions for any challenges its clients face, offering services scalable to income levels ranging from $100,000 to $100 million per year.

This focus on client income growth isn’t just a promise; it’s in Slingshot’s interest since their fee is 2% of the client’s monthly revenue. Notably, clients can add unlimited employees to the platform without affecting the pricing.

To date, Slingshot has announced raising $2.2 million in incremental funding during the development of its service.

What’s the Gist?

It’s no secret that modern musicians face unprecedented challenges when it comes to making a living. Platforms like Spotify, while offering global exposure, have fundamentally reshaped the economics of the music industry. Artists now rely on fractions of a penny per stream, requiring millions of plays to earn even a modest income. As a result, many musicians have turned to live performances, merchandise, and side gigs to sustain their careers.

This financial squeeze is particularly tough on independent musicians and smaller acts. For them, every dollar saved matters, which is where Slingshot’s tailored services for creatives become a game-changer. By handling their bookkeeping, taxes, and other administrative burdens, the platform allows musicians to focus on building their careers and finding alternative revenue streams.

Slingshot fits into a broader trend of startups offering accounting and financial platforms for niche markets. First, there’s Layer, a startup offering an embeddable accounting platform. Then there’s Haven, which we’ve covered earlier on Innovation Daily. Scaleup Finance and Puzzle are doing a very similar thing.

Slingshot’s standout feature, however, is its focus on musicians and creatives.

Beyond basic bookkeeping, financial management, payment processing, and banking services, Slingshot offers its clients access to fully equipped studios valued at $100,000, documentary video production, performance insurance, and free rentals of cameras, microphones, projectors, and other gear. The platform also provides connections to music distributors and streaming services.

Its concierge service goes further by sourcing video footage for music videos, licensing songs, finding designers, videographers, and photographers, providing live stream technical support, and fulfilling other niche requests.

Even with its 2% fee, Slingshot’s services are cheaper than running a private company. For instance, a musician earning $500,000 annually could save $89,000 by using Slingshot.

This is achieved through a unique model: instead of forming their own company, clients become employees or contractors of Slingshot Creative LLC. This structure grants Slingshot limited rights over the client’s creative output.

Each client and their team are treated as a separate division of Slingshot Creative LLC, with its own bank account for all operations. A centralized accounting team handles bookkeeping and tax filing for all these divisions, streamlining processes and reducing costs.

This straightforward model saves on expenses associated with running individual businesses and simplifies interactions between clients and the accounting team.

Key Takeaways

The brilliance of Slingshot lies in its pitch: “Do what you love. We’ll handle the rest.”

Would you give up 2% of your income for this? For those earning very little or a great deal, the answer might require some thought. But for most others, it’s a compelling offer.

Even traditional accounting and tax platforms like Haven are beginning to tie their pricing to revenue. Despite this, Haven achieved $1 million in annual revenue within a year and became operationally profitable.

Few enjoy dealing with taxes and bookkeeping, yet everyone earning money is required to. Thus, startups that allow clients to focus on what they love are likely to begin with accounting and taxes.

Building on this, startups can layer additional specialized services for selected customer segments. Some of these could be included in the base fee, while others might come as premium add-ons.

Interestingly, even startups that began with purely banking services, like Karat (offering credit cards for creators and influencers), are pivoting toward this model. Karat now provides accounting and tax filing services, organizes networking events, and has raised $115.6 million in funding.

Ultimately, the key to success may lie in narrowing the specialization.

For example, a general “bank for entrepreneurs” might feel too broad given the varying needs of different business types. But a “bank for marketplace sellers,” offering services like competitor analysis, catalog distribution, logistics, factoring, and access to suppliers, could hit the mark.

Which client segment would you design a Slingshot-style service for? What specialized services would you include? And how feasible is it to implement Slingshot’s legal model in your region?

Company info

Slingshot

Website: https://www.slingshot.fm/

Last funding round: $2.2 million, 29.05.2024

Total funds raised: $2.2 million over 1 round