Startup Spotlight #23: Art of the Middleman

Today's startup didn't invent anything groundbreaking or even new, yet they attracted nearly $100 million in funding. Sometimes, it's about being in the right place at the right time.

Project Overview

Before we look at today’s featured startup, we need to establish what a “virtual mobile service provider” is. A virtual service provider is a company that leverages the infrastructure of a “real” network carrier (towers and other systems) but offers mobile services under its own brand and pricing.

Businesses may choose to create virtual operators to strengthen user loyalty by bundling additional services with their core offerings. Think selling internet access alongside devices, offering attractive roaming packages for premium bank cardholders, providing mobile roaming services with travel packages, or crafting custom mobile plans for employees, sports club fans, or members of online communities.

The challenge is that becoming a virtual service provider has traditionally required direct negotiations with a “real” one (usually one of the large carriers), committing to significant traffic and data volumes, and developing custom software such as user dashboards and billing systems.

Today’s startup, Gigs, greatly simplifies this process by providing a platform where any company can quickly and easily launch a virtual mobile service using pre-built components.

Effectively, Gigs acts as a middleware between real network carriers and companies aspiring to become virtual ones. Businesses no longer need to negotiate lengthy agreements — they simply select the services they need. Easy peasy.

Here are the key components of the Gigs platform:

1. No-code plan builder: lets you create custom mobile plans with associated web pages, including plan descriptions, service selection, tariff switching, and other details. No programming is needed — just choose the elements, add your content, and boom.

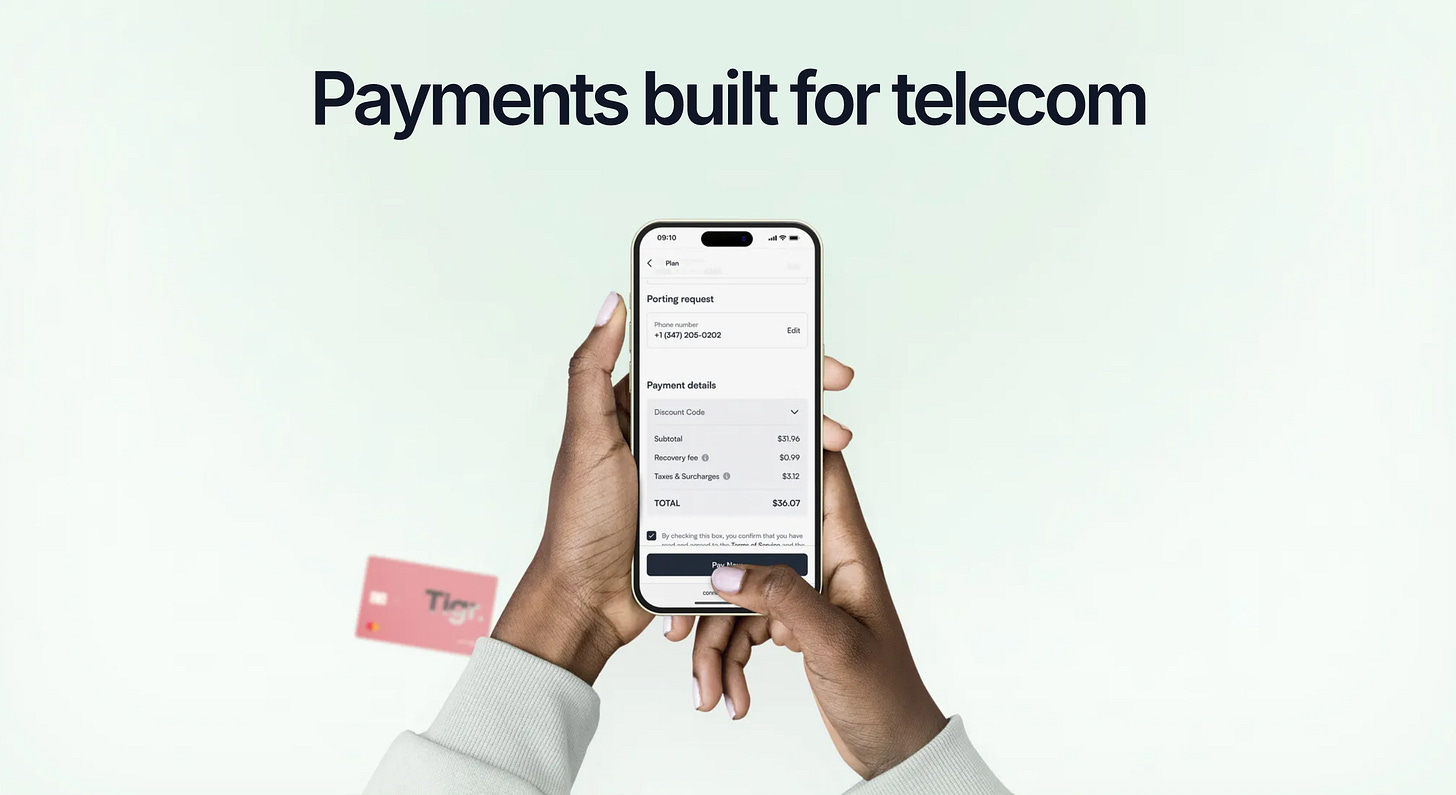

2. Payments system: handles transactions, tracks usage, deducts subscription fees, processes refunds, calculates sales taxes, and manages other financial operations.

3. AI customer support assistant: automatically answers questions about plans and services and resolves customer issues, eliminating the need to hire specialized staff. But it doesn’t just answer questions — it can actually do stuff, like upgrading your plan on-the-fly/

4. Dashboard: provides company executives with insights into service performance, technical metrics, and financial data.

For deeper integration, Gigs offers an API, enabling companies to manage operations such as purchasing and modifying mobile plans programmatically.

Gigs first gained attention in 2022 after securing $20M in equity investments and $4M in convertible debt. Recently, the company raised $73M in new funding and launched a partnership with Vodafone to find startups interested in offering mobile services to their users.

What’s the Gist?

On the same day Gigs announced its $73M funding, another startup, Upvest, revealed a €100M investment round, bringing its total funding to nearly $200M.

Upvest offers a platform that allows any cloud service to provide stock and fund trading to its users, functioning as a “virtual investment broker.” Like Gigs, Upvest isn’t a “real” broker but a middleware layer, offering pre-built modules for rapid integration. Companies can use these modules to set up user dashboards with trading functionality without needing extensive development expertise.

Conceptually and technologically, Upvest mirrors Gigs — only it operates in investments rather than mobile services. Upvest’s API also enables deeper functionality, allowing companies to customize how investment services are embedded into their platforms. This opens doors for innovation, such as enabling users to trade stocks directly from apps designed for completely unrelated purposes, like wellness tracking or gaming.

What sets both Gigs and Upvest apart is their ability to simplify integration and reduce operational complexity. This approach makes it possible for businesses to enter markets that previously required significant expertise or resources, such as telecommunications or financial services. By offering modular solutions, they lower the barriers for adoption, making these services accessible to a wider range of businesses.

Their reliance on a single partner as the real service provider is another interesting aspect. For Gigs, this means working with major telecom providers that offer a full range of services. For Upvest, it involves integrating with established brokerage firms. While this simplicity works well in their industries, other fields may require aggregating multiple partners to achieve the same level of functionality.

For instance:

• E-commerce: Rye aggregates numerous retailers, enabling any cloud service to offer a catalog of millions of products through its API. This allows apps to include shopping functionality without needing to establish relationships with individual retailers.

• Food delivery: MealMe connects cloud services to a network of restaurants and grocery stores, enabling users to order from a million outlets. This approach extends the utility of existing apps, like enabling a co-working space app to offer food delivery from nearby restaurants.

These examples highlight a broader trend: cloud services are becoming platforms for embedding additional functionalities, making them more versatile and valuable for their users. Middleware platforms like Gigs, Upvest, Rye, and MealMe are at the forefront of this transformation, offering tools that democratize access to traditionally complex services.

Key Takeaways

Most startups focus on inventing new services to meet emerging needs. However, the success of Gigs and Upvest highlights an alternative path: combining existing, in-demand services into middleware platforms with modular components. These platforms act as connectors, enabling businesses to adopt complex functionalities without the heavy lifting traditionally required for development and integration.

This approach isn’t new — Plaid popularized it by integrating U.S. banks and financial services into a unified API, allowing users to manage accounts from cloud services.

What Plaid did for financial connectivity, Gigs and Upvest are now doing for telecommunications and investment services, respectively. Their success demonstrates that there is a growing demand for solutions that streamline integration and reduce the time-to-market for businesses.

Today, this concept is gaining renewed traction, as evidenced by the significant funding rounds for Gigs and Upvest. Investors recognize the value of these platforms as they enable businesses to diversify their offerings, improve customer retention, and unlock new revenue streams. For companies, middleware platforms represent an opportunity to provide more comprehensive services to their users, differentiating themselves in competitive markets.

Here’s the takeaway: consider creating middleware platforms to integrate popular services into cloud platforms. Successful platforms often share the following characteristics:

• Convenience for users: The services integrated should provide real value to end-users, making their experiences smoother and more enjoyable. Examples include enabling users to trade stocks, manage mobile plans, or order food seamlessly within unrelated apps.

• Flexibility for businesses: Platforms should offer customizable modules or APIs, allowing businesses to tailor the services to fit their unique needs without requiring extensive technical expertise.

• Scalability: middleware solutions must be capable of scaling alongside their clients, supporting more users, transactions, or integrations as demand grows.

Some key questions to explore:

• Which services can be integrated to enhance user convenience and increase revenue?

• Is one partner sufficient, or is aggregation needed to cover a broader range of services?

• What modules are essential for fast, seamless integration with new cloud services?

• How can the platform ensure compliance with regulations across different regions or industries?

By answering these questions, you can identify opportunities to build platforms that provide value to businesses and users alike, fostering innovation and growth in a competitive market. The path forward lies not in reinventing the wheel but in finding smarter, more efficient ways to connect it to existing systems.

Company info

Gigs

Website: https://gigs.com/

Last funding round: $73 million, 12.12.2024

Total funds raised: $97 million over 4 rounds