Startup Spotlight #35: A Revolution in IT Sales

Today's featured startup is applying a new strategy to a familiar field.

Project Overview

Jotelulu is a cloud service provider tailored to small and medium-sized businesses. While its cloud offerings may not be anything groundbreaking, its sales strategy is relatively unique. Jotelulu enables IT companies serving SMBs to resell its services to their clients.

Through this approach, IT companies gain a new revenue stream without expanding their customer base. They can also offer customized solutions by integrating Jotelulu’s cloud services into their own offerings.

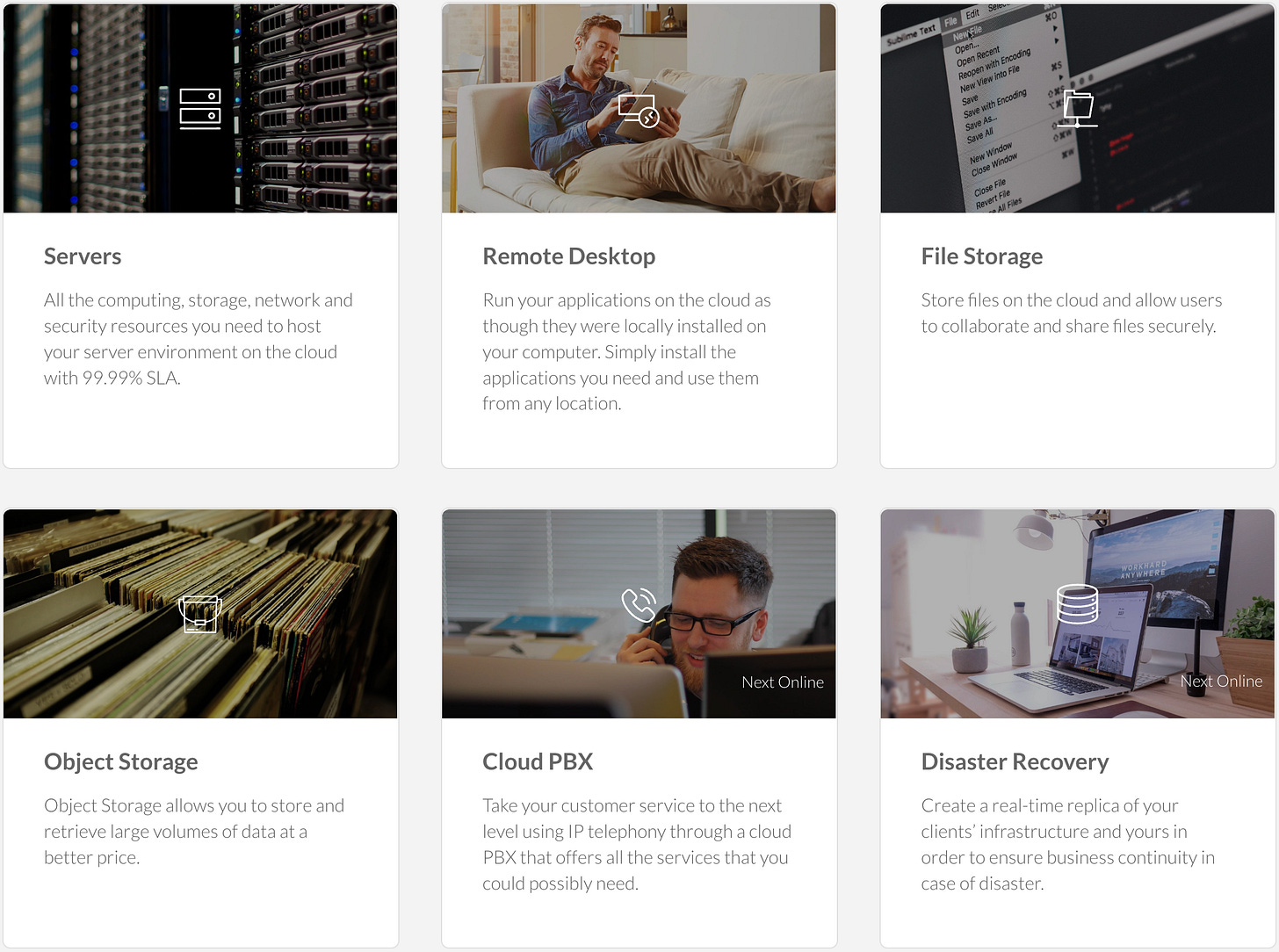

The lineup of resaleable services includes foundational elements such as servers, file and data storage, remote desktops, IP telephony, ticketing systems, and an extensive marketplace of cloud software and hardware.

Crucially, IT companies can rebrand Jotelulu’s services under their own name, creating the impression that these services are provided directly by the IT company itself.

While similar reselling opportunities exist with major cloud providers, Jotelulu offers a critical advantage: clients are unaware of the underlying provider. This reduces the risk of clients bypassing the IT company to purchase directly from the original cloud provider.

Jotelulu’s model is also financially attractive. Resellers enjoy higher margins, flexible pricing structures, and the ability to bundle Jotelulu’s services with their own offerings. To incentivize growth, Jotelulu awards credits based on the number of clients and services sold. These credits can offset the reseller’s Jotelulu expenses, potentially making their infrastructure costs negligible while generating profits from the resale.

Founded in Spain, Jotelulu now works with over 1,000 IT companies across Spain, Portugal, and France. The company’s revenue is growing threefold annually, supported by €6.8 million in new investments, bringing its total funding to €11.8 million.

What’s the Gist?

Historically, goods were sold through layers of intermediaries — producers to distributors, distributors to retailers, and retailers to consumers. The rise of the internet disrupted this model, enabling direct-to-consumer sales. Software developers were among the first to embrace D2C, using the internet to sell their products directly, eventually evolving into cloud service providers.

While the D2C model thrived initially, the cost of acquiring customers online has skyrocketed, making direct sales increasingly unprofitable in competitive markets. This shift has prompted a reevaluation of the D2C standard, with a growing trend toward selling IT services through intermediaries.

Intermediaries with pre-existing relationships with target customers — like IT companies already serving SMBs — can resell services at a lower customer acquisition cost than the original provider. Jotelulu capitalizes on this by equipping IT companies with the tools to resell its cloud services to their existing clients.

This intermediary-driven model is also gaining traction in the SaaS sector. Startups like Uprise (financial advisor marketplace), Layer (accounting platform which we’ve covered previously on Innovation Daily), and Upvest (private investment platform) are embedding their services into other SaaS products, enabling seamless reselling.

An even broader example is Vendasta, which empowers web studios and marketing agencies to resell cloud services under their own brands. It also acts as a distributor, attracting SaaS developers to list their services for resale. Vendasta has raised $185 million, positioning itself as a “middleman for middlemen.”

Key Takeaways

The intermediary-driven sales model, while not yet mainstream, is rapidly gaining traction as customer acquisition costs continue to rise. For IT companies already serving SMBs, reselling services like Jotelulu offers a low-cost way to generate additional revenue without expanding their client base.

For developers of IT and SaaS services, the growing trend toward integration and resale through intermediaries presents a significant opportunity. Companies like Uprise, Layer, and Upvest demonstrate the viability of embedding services into third-party platforms.

For those looking to think bigger, Vendasta’s “middleman for middlemen” approach highlights the potential to create distribution networks that connect developers with resellers. As this model evolves, niche distributors focusing on specific industries or service types may emerge, creating even more opportunities.

In short, whether you’re a developer, a reseller, or a prospective distributor, the rise of intermediary-driven sales opens up a wealth of possibilities. What role do you see yourself playing in this rapidly changing landscape? Let us know in the comments!

Company info

Jotelulu

Website: https://jotelulu.com/en-gb/

Last funding round: €6.8 million, 02.12.2024

Total funds raised: €11.8 million over 2 rounds