The $100 Billion Fee Market Under Threat

Today's featured startup is showing how AI can turn a traditionally commission-heavy industry into a simple, fixed-price transaction

Project Overview

Beycome is a real estate service designed to help homeowners sell residential property while avoiding traditional realtor commissions.

At the core of the platform is an AI assistant called Artur. It helps sellers price their home correctly, publish listings across multiple real estate marketplaces, schedule showings, prepare required legal documents, and coordinate the entire transaction — from listing to closing.

In the U.S., sellers typically pay around 5.5% of a home’s sale price in commissions, usually split evenly between the seller’s agent and the buyer’s agent. As a result, nearly 90% of home sales still involve at least one realtor.

With the median U.S. home price at roughly $400,000, the average commission per transaction reaches about $20,000.

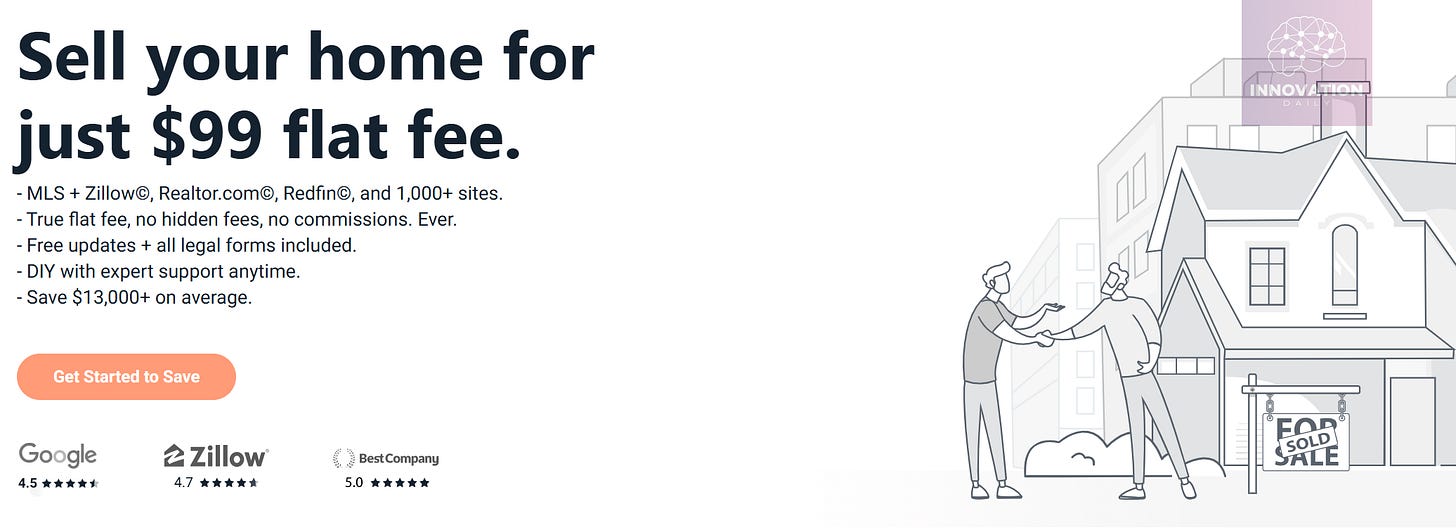

Beycome offers a radically simpler alternative. A home can be sold for a flat fee of $99, which includes listing distribution, legal document templates, and human support when questions arise during the process.

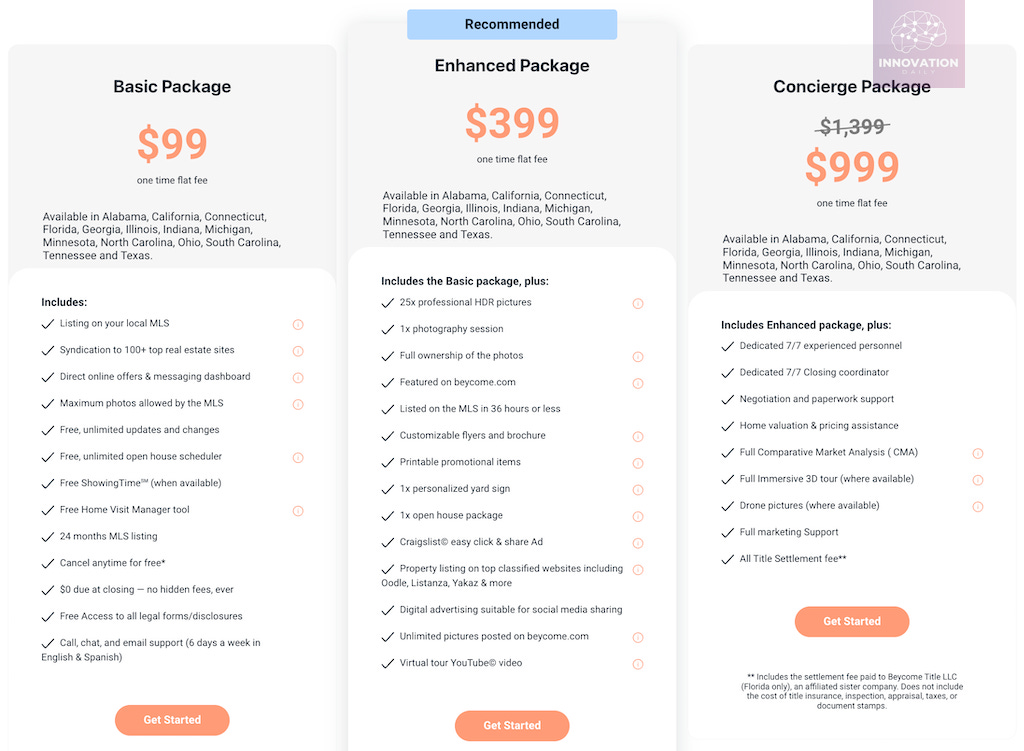

More advanced fixed-price plans are also available:

$399 — professional photos, video, marketing materials (flyers, brochures, yard signs), and ready-to-run online ads

$1,399 (currently $999) — a 3D home tour, drone photos of the neighborhood, a pricing justification report, and hands-on support from marketing and transaction specialists through closing

If a buyer uses Beycome, they can also receive up to 2% cashback when the seller is represented by a traditional agent — effectively returning most of the buyer-side commission to the buyer.

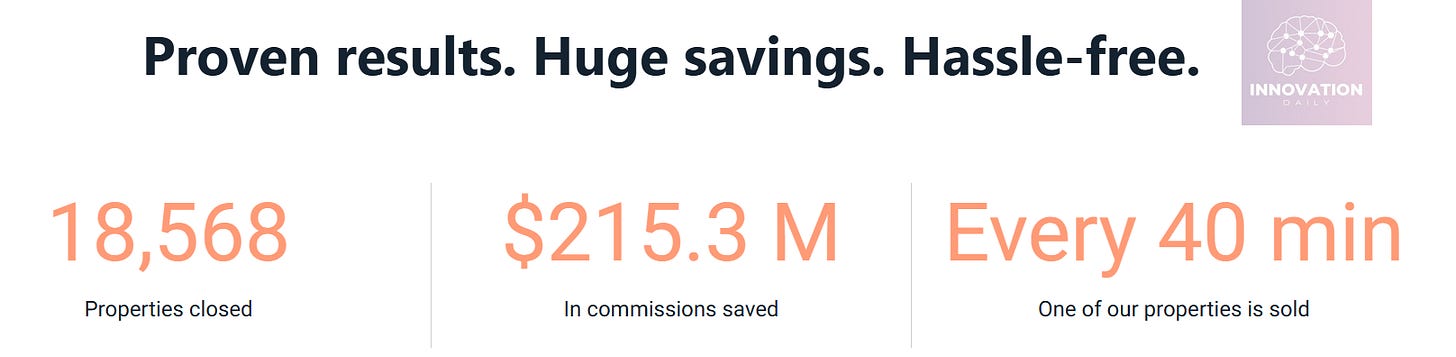

Founded in 2020, Beycome has already facilitated around 19,000 real estate transactions, saving sellers more than $215 million in commissions. The platform now closes a new deal every 40 minutes.

After raising several small investment rounds between 2020 and 2022, the company became operationally profitable last year. In September, Beycome raised an undisclosed round, followed shortly by a $2.5 million funding round.

What’s the Gist?

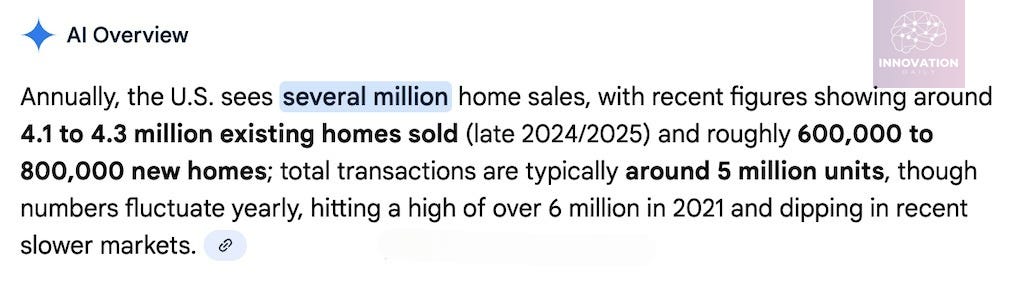

The U.S. residential real estate market is massive. Roughly 5 million homes are sold each year, with about 80% being existing homes sold by owners.

That puts the total transaction volume between $1.5 and $2.8 trillion annually, while realtor commissions alone generate $80–150 billion per year.

Beycome is targeting this commission pool — even though its flat-fee model captures far less revenue per transaction than traditional agents. Still, the company is already profitable. Capturing just 1% of the market at an average fee of $500 would translate into $25 million in annual revenue.

So why are investors paying attention now?

The key shift is that dissatisfaction with realtor commissions has reached a breaking point. In October, a U.S. federal court ordered the National Association of Realtors and co-defendants to pay $1.8 billion in damages for unlawfully inflated commissions on more than 260,000 home sales.

This ruling is expected to set a precedent. Analysts anticipate the $100-billion commission market could shrink by at least 30%, forcing around 1.6 million realtors out of the industry.

In short, long-standing industry norms are starting to collapse. What was once considered “just how real estate works” is now openly questioned — legally, economically, and culturally.

As sellers begin actively searching for ways to sell without commissions, Beycome suddenly looks perfectly timed.

What’s especially interesting is that Beycome is not just another “commission-free marketplace.” While it does operate its own marketplace, that’s not the core of the business.

Instead, Beycome acts as a transactional layer — helping sellers complete legally sound, end-to-end transactions while listing their property across any sales channel.

Conceptually, it resembles what PayPal once did for eBay and later for the broader internet: not a marketplace, but an infrastructure layer that makes transactions simple and safe.

That simplicity is now powered by a specialized AI system capable of handling the most painful parts of real estate transactions — from paperwork to compliance. This is the second major enabler: AI has finally become good enough to replace large parts of what humans used to justify high commissions for.

Key Takeaways

Realtors have frustrated property sellers for years — not only in the U.S. One obvious opportunity is another direct attack on commission-based models, betting that market pressure has finally reached a tipping point.

But the broader pattern goes beyond real estate.

AI is dramatically reducing the cost of services that were once expensive simply because they required human labor. In many cases, this doesn’t just make services cheaper — it makes them cheap enough to unlock entirely new audiences.

This is especially visible in legal and adjacent fields: filing complaints, employment disputes, tenant issues, and other cases where potential compensation is far lower than traditional legal fees.

AI-powered legal services — charging a fraction of the cost or taking a percentage of outcomes — massively expand access to justice.

And legal services are just the beginning.

The real question is: in which other industries can AI make previously “too expensive” services radically affordable — and in doing so, create entirely new markets?

Company Info

Beycome

Website: beycome.com

Latest Round: $2.5M 18.12.2025

Total funding: $3.7M across 6 rounds