The Hidden Market for Unsold Goods

Today’s featured startup is unlocking new cash flow for small retailers by connecting them to global buyers of unsold stock.

Project Overview

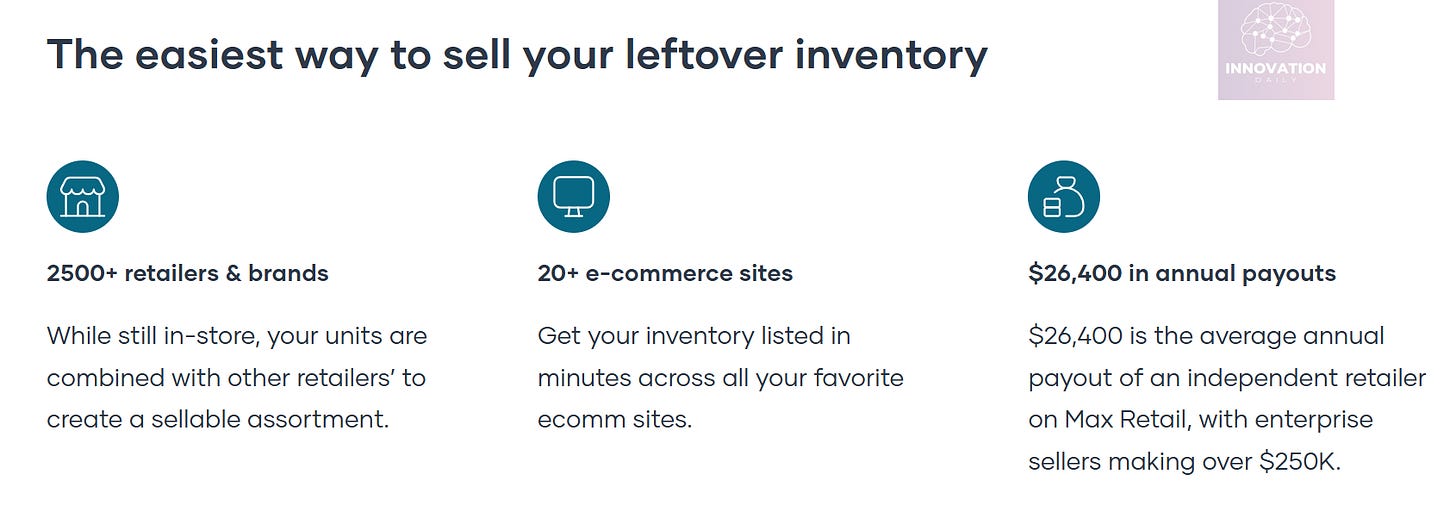

Max Retail helps retailers turn excess inventory into real revenue.

Instead of organizing deep discount sales that hurt margins and damage brand value, Max Retail connects sellers to a curated network of off-price and full-price retailers—locally and globally—who are willing to buy unsold stock.

The process is simple: retailers register, pass verification, upload their product lists, and start selling. The platform doesn’t buy or resell anything itself—it’s a closed marketplace where retailers and distributors trade directly.

From individual items to bulk lots, the system works for all scales. On average, sellers recover about 90% of their wholesale price, losing far less than they would in a clearance sale. No wonder over 2,000 sellers have already joined.

What’s the Gist?

Inventory that just sits on warehouse shelves is essentially frozen capital. Retailers can’t reinvest it, and it often loses value over time. Globally, this problem is massive—over $500 billion worth of goods are stuck in retail warehouses at any given moment.

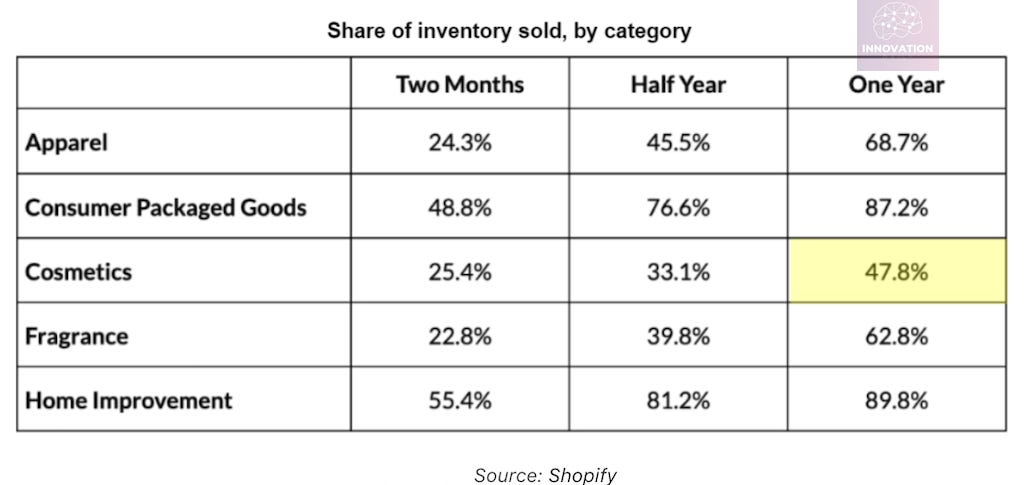

Fashion is a particularly bad offender:

Only 24% of clothing sells in the first 2 months

Just 69% is sold within a year

For cosmetics, it’s even worse: only 48% moves in a full year

Retailers are desperate for better liquidation tools. Max Retail offers a middle ground: instead of running destructive 75% off sales that train customers to wait for discounts, sellers offload excess inventory discreetly to others who can sell it for full or near-full price.

It’s a smart twist on resale:

Ghost, a similar startup, raised $68M by enabling wholesale liquidations—but it’s focused on large-scale sellers.

Max Retail targets the 98.6% of small retailers who often get ignored, helping them earn an average of $1,100/month from overstock.

While 2,000 sellers isn’t a huge number, the upside is enormous if Max Retail can scale to serve this massive segment.

Meanwhile, others are tackling the problem from different angles:

Yaysay built a TikTok-style app for consumers to buy unsold inventory in flash-sale format.

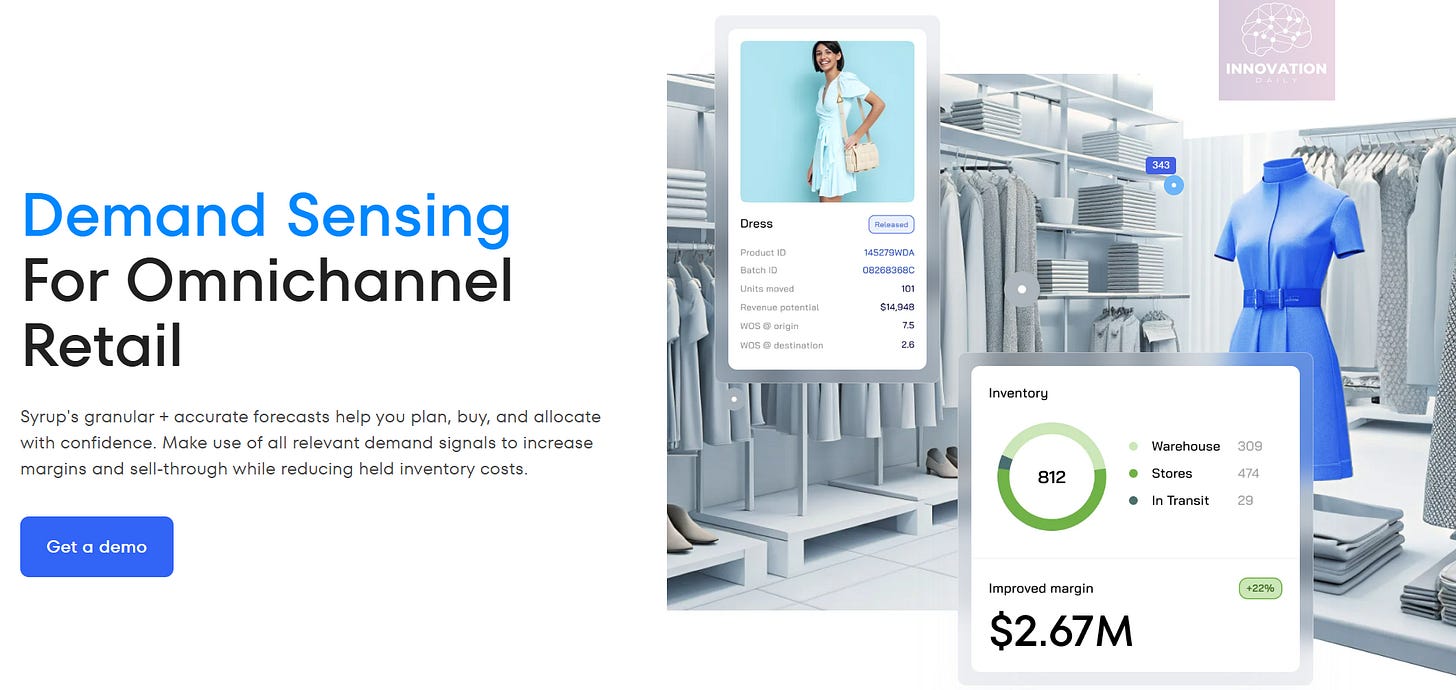

Syrup uses AI to help brands avoid overstock in the first place by forecasting demand with remarkable accuracy.

Givz and ChangeUp help retailers turn potential discounts into charitable donations—another way to preserve value.

Key Takeaways

Here’s a playbook worth exploring:

Source sellers from developed markets with consistent overstock.

Source buyers from developing regions with unmet demand and limited access to affordable, quality products.

This cross-border arbitrage—moving goods between mismatched economies—is where the opportunity lies.

It’s a model that has already proven itself in talent marketplaces:

Microverse, for example, raised $19.7 million to train tech talent in Latin America and Africa and connect them with employers in the U.S. and Europe.

Propel, which bypasses training entirely and taps directly into African developer communities, has raised $2.9 million.

The same logic could apply to goods: oversupply in one region, unmet demand in another.

In fact, the flow can go both ways:

Startups like The Folklore are proving that fashion from emerging markets can find buyers in the West, especially when it offers something unique.

Bottom line: whether you’re moving surplus clothes from L.A. to Lagos, or indie designs from Nairobi to New York, the mechanics are similar. The real lever is globalization.

And you won’t test that by building a tiny MVP in just one country.

Company Info

Max Retail

Website: maxretail.com

Last round: $15M, 29.04.2024

Total Investment: $20.9M+, around 4 rounds