The Hidden Shift

Today’s featured startup is giving overworked employees a lifeline — and companies a way to keep them.

Project Overview

Cariloop opens with a bold claim: “Up to 73% of your employees are struggling because they’re responsible for caring for a loved one.” Whether it's parents raising children, adults looking after aging parents, or someone supporting a chronically ill family member, caregiving takes a toll — on time, energy, emotional well-being, and job performance.

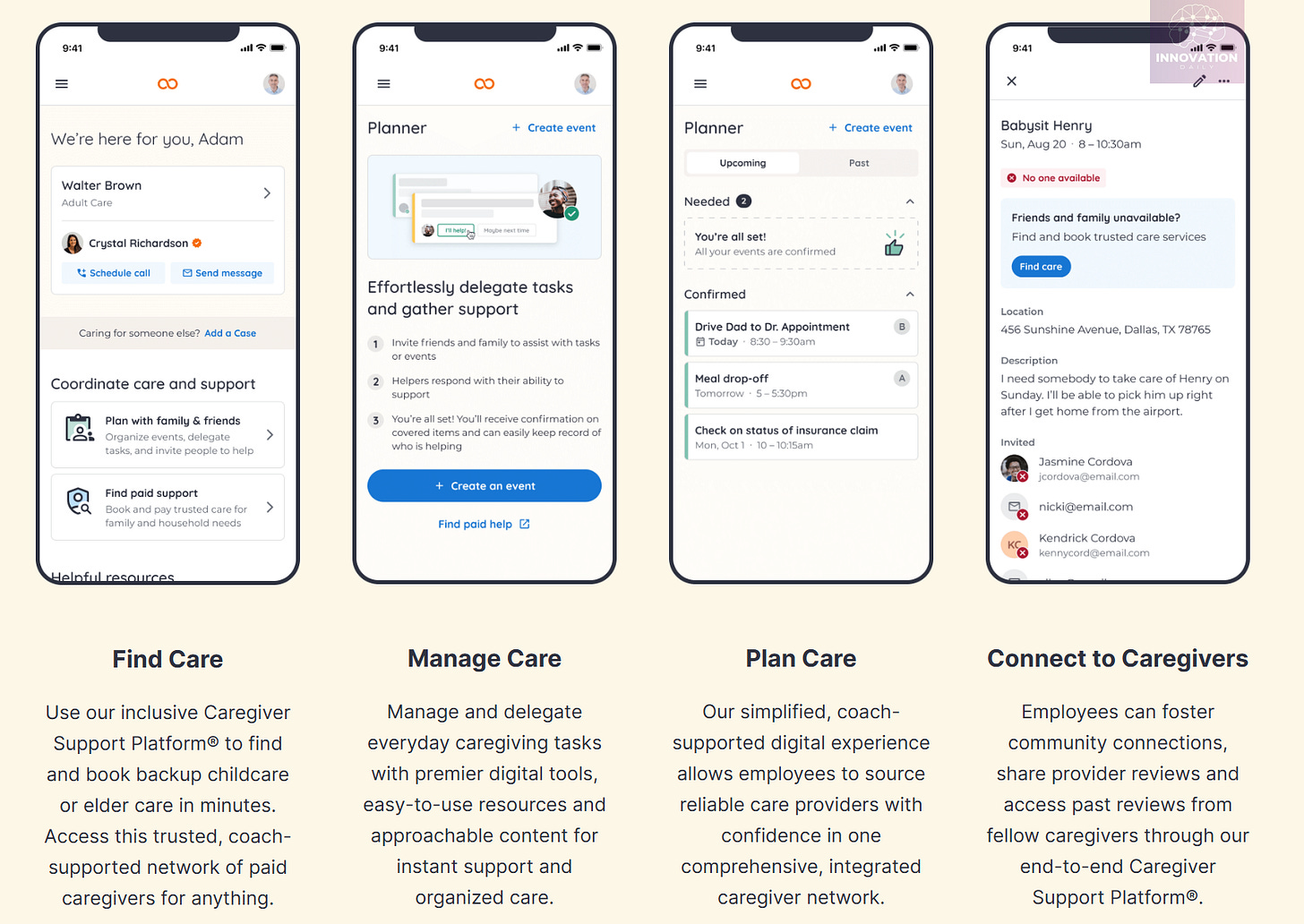

To ease that burden, Cariloop offers a comprehensive support platform. Through its app, users get access to mental health services, professional consultations, caregiver assistance, legal and financial help — all in one place. The platform also features a peer community for sharing advice and emotional support.

Each user is paired with a dedicated coach who helps develop a care plan, answers questions, and manages tasks that can be delegated. While anyone can technically sign up individually, Cariloop’s real target is employers — and that’s where the business model gets interesting.

Rather than pitching directly to individuals, Cariloop works B2B, selling its service to companies who then provide it as a benefit to their employees. The value proposition? American businesses lose an estimated $44 billion annually in productivity, absenteeism, and turnover due to caregiving-related challenges. Cariloop aims to help them cut those losses.

According to the startup, their clients have seen a 3x return on investment, recapturing over 300,000 work hours that would’ve otherwise been lost. While Cariloop isn’t new, the last three years have marked a significant growth phase — revenue has quadrupled, and Net Revenue Retention now stands at 120%, indicating that clients are expanding their use of the platform. The startup recently raised $20 million in funding, bringing its total to $43.1 million.

What’s the Gist?

A Quiet Crisis — and a Booming Market

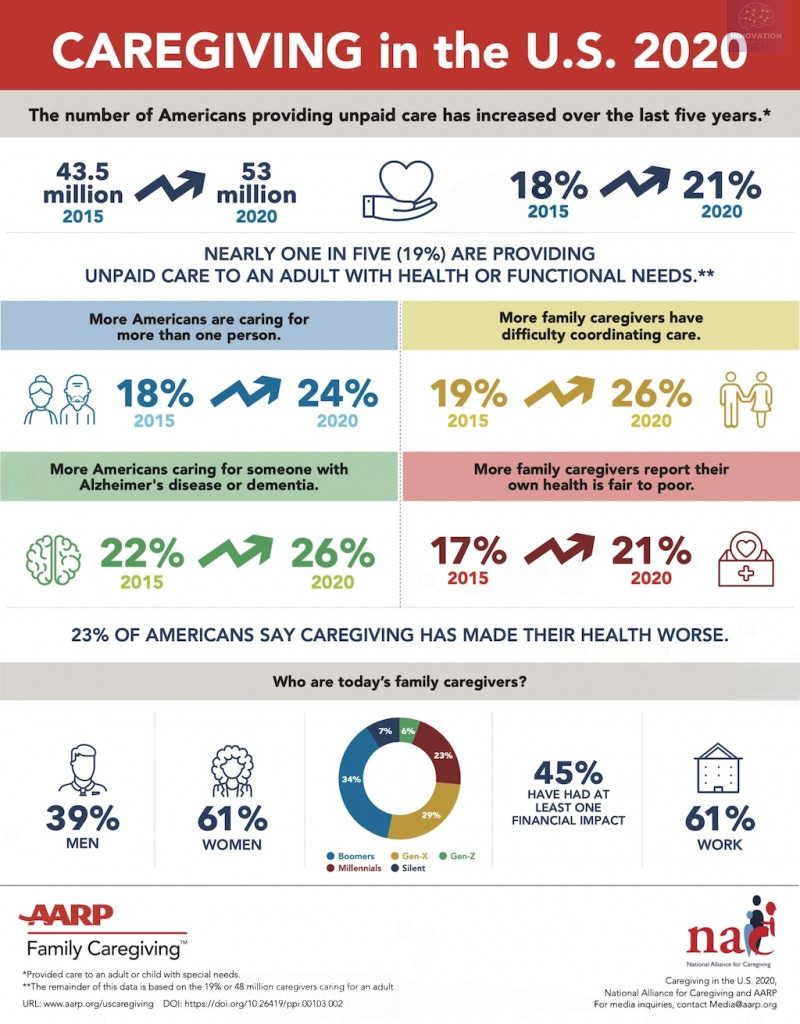

Cariloop isn’t exploiting fear — the crisis is very real. The number of Americans caring for loved ones is staggering and rapidly growing. In 2015, it was 43.5 million people. By 2020, that number had surged to 53 million — roughly 19% of the population. Over 60% of them are employed, and 21% say their own health is suffering as a result.

This isn’t a temporary spike. It’s a long-term demographic shift. The U.S. population is aging: in 2020, there were 35 million Americans over 65. By 2060, that number will nearly triple to 94.7 million. In percentage terms, seniors will go from 13.1% of the population in 2010 to 22% by 2050.

As caregiving needs rise, companies will continue to face mounting operational challenges. And Cariloop isn’t alone in addressing this pain point.

Wellthy, a similar platform offering employer-sponsored caregiving support, raised $78 million. ianacare, another player in the space, has raised $18.1 million to date — including a new round following strong market demand.

Key Takeaways

A Market Ripe for Innovation — and Urgently Needed

The demand for employer-sponsored caregiving support is being driven by two forces:

The pressure to do more with less. Companies are under financial strain and must maintain — or even increase — productivity with fewer people. Caregiving responsibilities eat into an employee’s mental and physical capacity to perform at full potential.

The aging population. More seniors means more employees juggling work and caregiving — further reducing workforce efficiency.

There’s unlikely to be a monopoly in this space. These platforms don’t rely on strong network effects, so multiple players can thrive. That opens the door for new startups to enter the field — particularly those focused on practical support for family caregivers.

The model is straightforward and proven. What’s required isn’t complex tech — it’s the ability to sell the service to companies. Fortunately, the need is clear, the timing is right, and the market is large. That’s a rare combination — and an open invitation for founders ready to tackle a meaningful problem.

Company Info

Cariloop

Website: cariloop.com

Last round: $20M, 09.04.2024

Total investment: $43.1M across 7 rounds