The Next Big Shift in Personal Finance

Today's featured startup is turning hybrid advisory into the new standard for smart, stress-free investing

Project Overview

Fifr (Finding Financial Freedom) is an investment app that blends automation with human expertise.

But this isn’t yet another robo-advisor — and the team stresses that “your money deserves more than generic algorithms.”

In Fifr’s model, technology handles only repetitive tasks where automation truly wins: real-time price monitoring, auto-executing buy/sell orders, and other routine operations.

Everything else — deciding what should be automated and why — is guided by real financial experts.

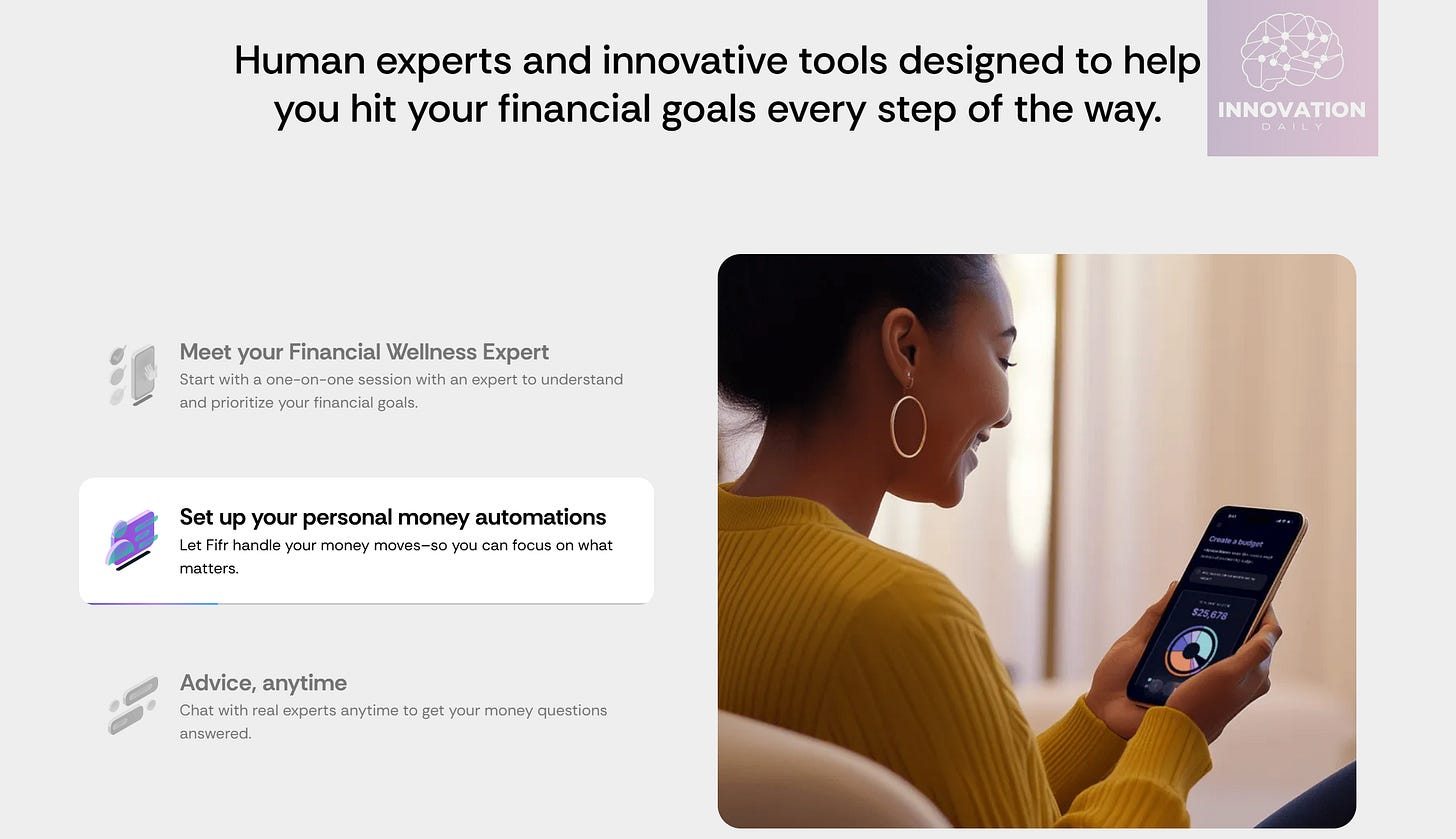

Users start with an online session where they outline their goals and risk preferences. The consultant then recommends a strategy and sets the rules for automated execution. Once approved, the system takes over — but the human consultant remains available at any moment for questions, reassurance, or strategic adjustments.

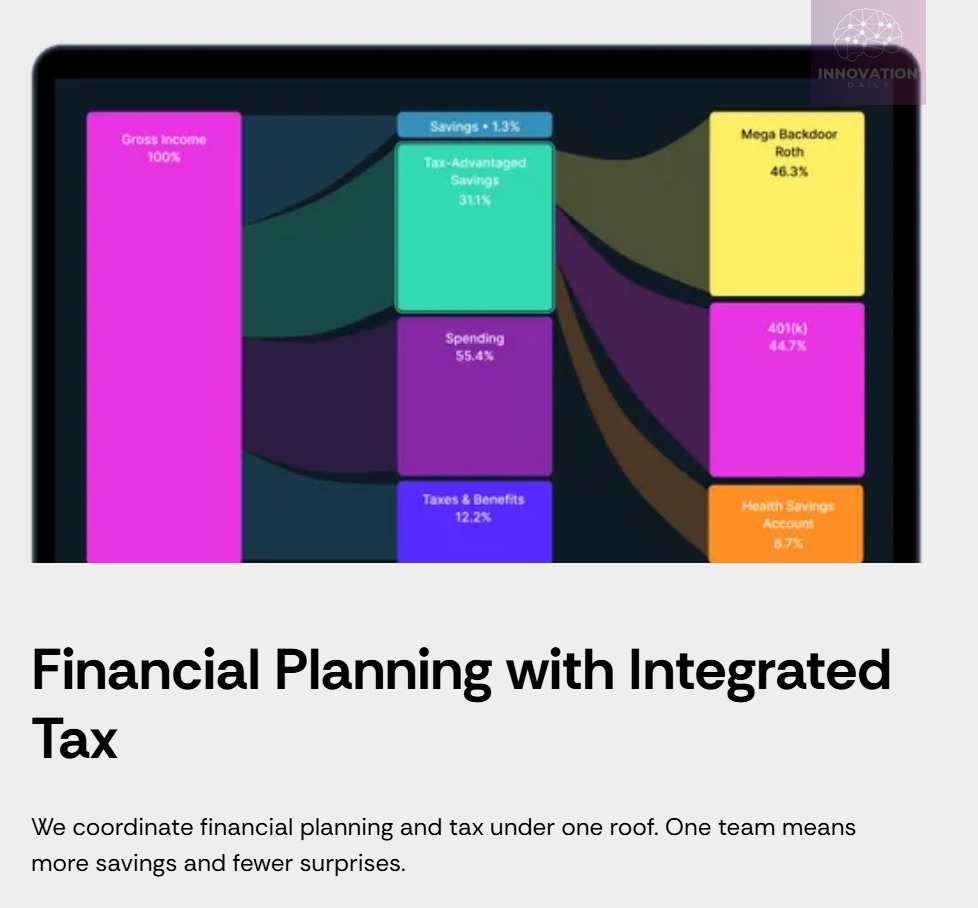

A major advantage: consultants offer integrated guidance that covers not only investment returns but also taxes and tax-efficient planning, maximizing the user’s overall income.

The pricing model is refreshingly simple: a flat $99 per month, regardless of assets under management.

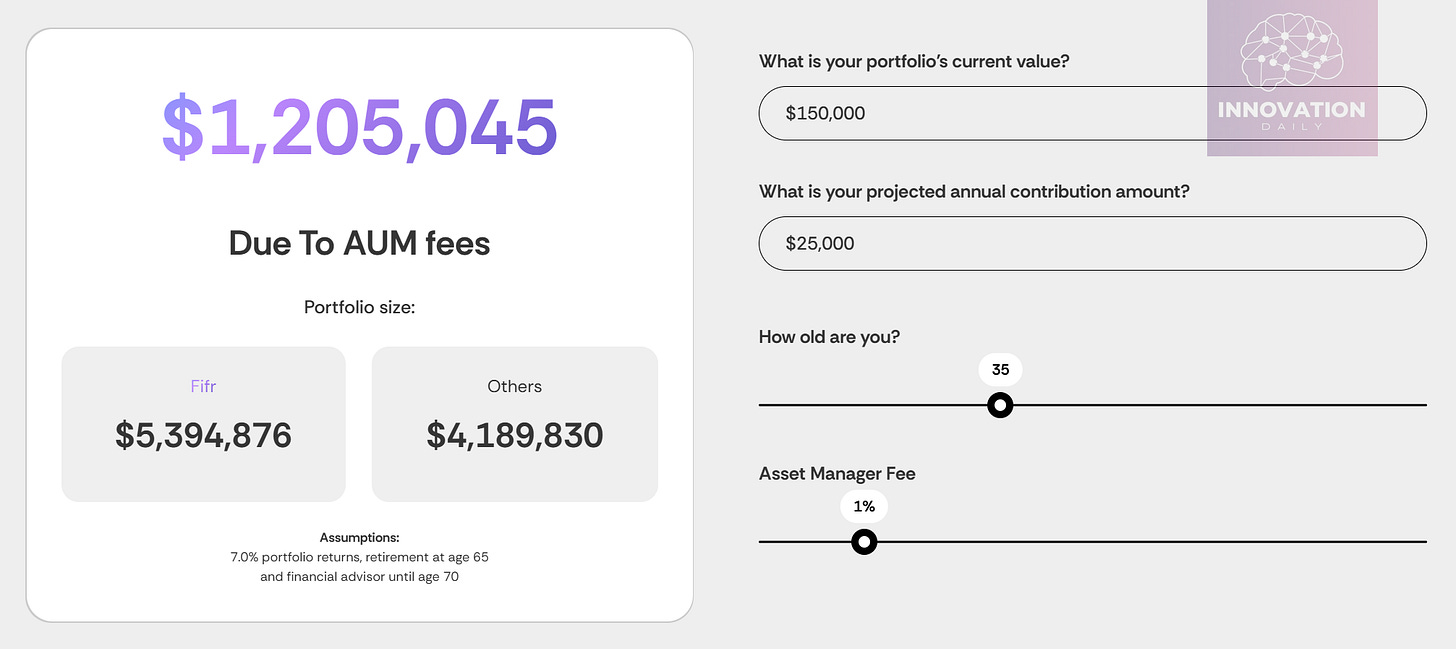

Compared to traditional advisors charging 0.75–1.5% AUM — or advanced robo-advisors at 0.25–0.5% — the difference compounds dramatically over time.

For example, a 35-year-old starting with $150K and contributing $25K annually would end up with $5.4M using Fifr vs. $4.2M with a 1% advisor fee — a $1.2M difference.

The target audience: founders, startup employees, and professionals earning over $150K annually.

And the model resonates — 95% of users stay, largely thanks to the sub-30-minute response time from human consultants.

Alongside the direct-to-consumer offering, Fifr is also testing a B2B model, pitching companies on corporate subscriptions for higher-earning employees.

Recently, the startup raised its first $1.5M round.

What’s the Gist?

Trust is the deciding factor when choosing a financial advisor — more important than cost, credentials, or historical performance.

Around 60% of Americans say trust is their top criterion, while only 31% prioritize past returns. And the wealthier the user, the more trust matters: 68% of high-income respondents list it as their #1 factor.

Despite rising confidence in AI, people still trust humans more — especially where judgment matters. But when it comes to routine, mechanical actions, AI often inspires more confidence (think calculator vs. longhand math).

That’s why Fifr’s hybrid model feels so natural: humans help define long-term strategy, AI executes it flawlessly, instantly, and without emotional bias. And the user always retains the option to talk to a real expert.

Hybrid advisory models are gaining traction across multiple industries where people need:

• high trust

• fast response times

• complete information

• and the comfort of speaking to a human

The pattern is already visible in other verticals:

Counsel — raised $25M for an “ideal doctor” platform where users get 24/7 AI medical advice and can pull in a human physician anytime.

The base tier is unlimited AI chat; live doctor consults cost $29 each, or become unlimited with a $199 annual plan.

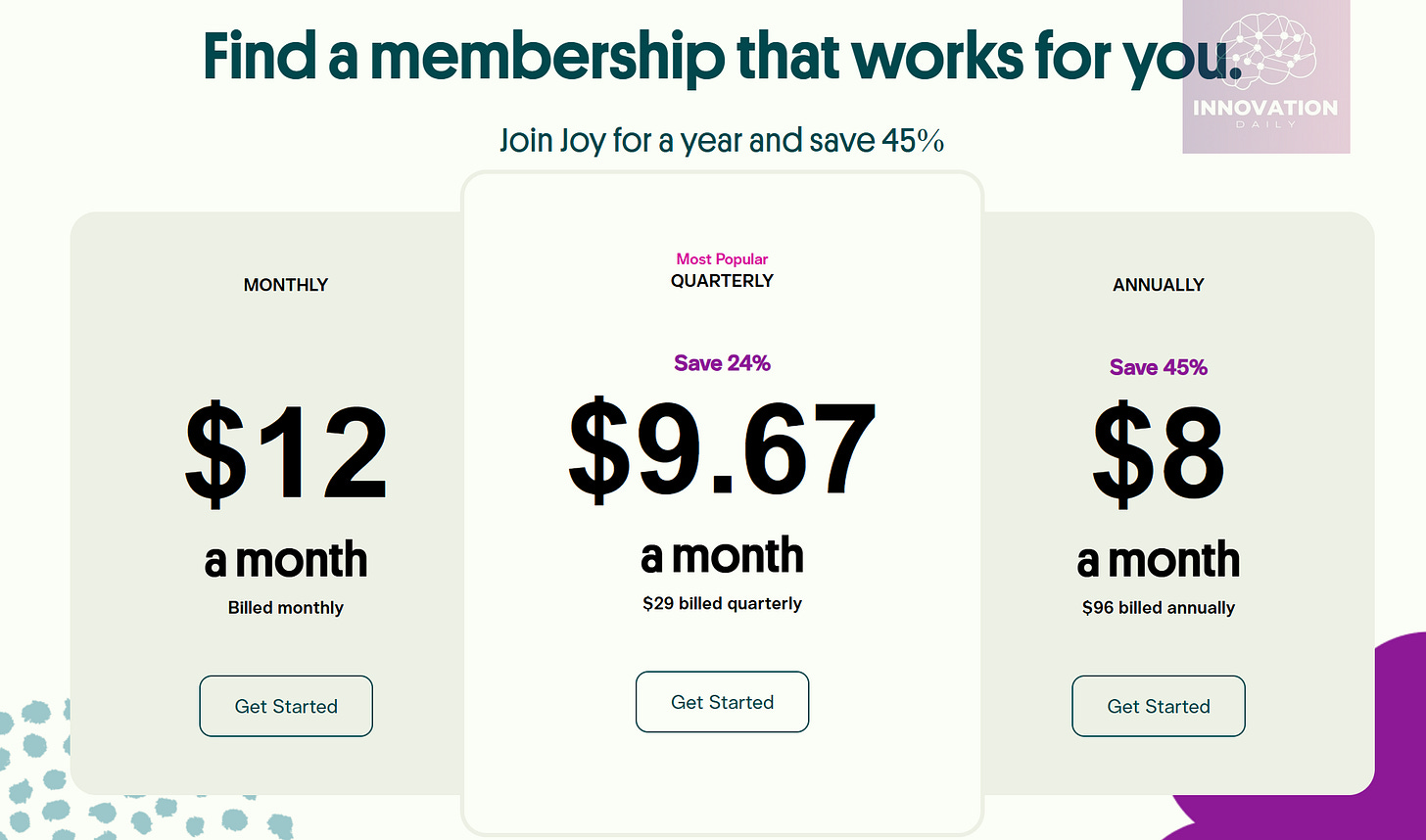

Joy — raised $14M for an AI-plus-human parenting advisor.

Users get 24/7 AI support + access to on-call specialists for $12/month, with optional video consultations costing $100–$120 per session.

Across health, parenting, and now finance, hybrid models are proving that people want instant AI guidance and access to humans for reassurance and nuance.

Key Takeaways

The direction is clear: hybrid advisory services where AI handles most requests, and human experts step in when needed — either included in the plan or billed separately.

Health, parenting, and financial planning are obvious fits.

But these aren’t the only markets large enough to support this model. The real question is:

What other domains could benefit from an AI-first, human-backed advisory model?

Now is the moment to start building them.

Company Info

Fifr

Website: fifr.io

Latest round: $1.5M (November 25, 2025)

Total funding: $1.5M across 1 round