The Platform Behind the Platform

Today’s featured startup is giving retailers the tools to print money from their traffic.

Project Overview

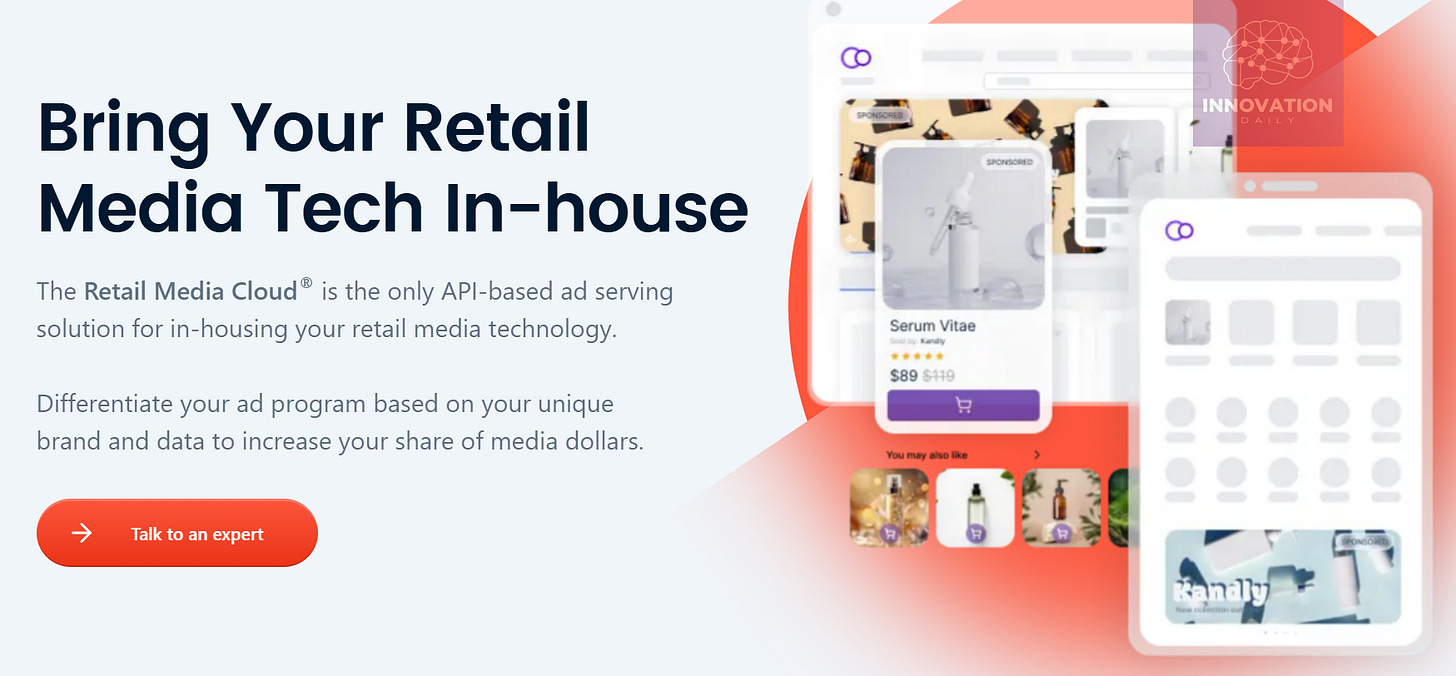

Kevel is a platform that empowers companies to launch their own advertising networks — no Google or Meta required. While technically anyone can use the platform, Kevel’s primary focus is on what’s known as Retail Media — and their core product is aptly named the Retail Media Cloud.

Retail media refers to a fast-growing model where online retailers, marketplaces, and e-commerce players generate additional revenue by offering paid ad placements to brands and sellers featured on their platforms.

Kevel’s platform consists of two main modules:

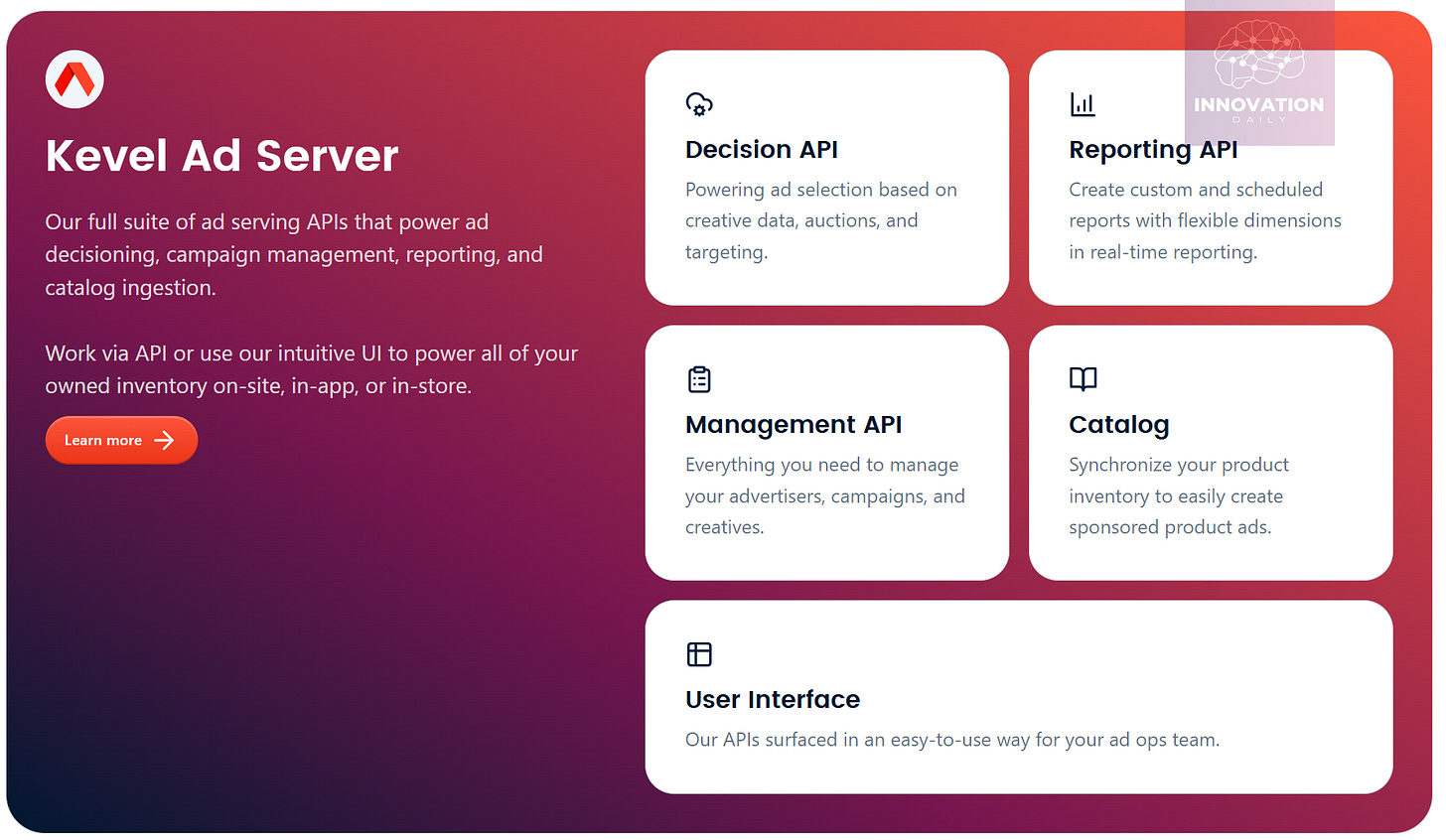

Ad Serving Engine — Supports multiple pricing models (flat rates, auctions), includes a self-serve interface, analytics, and even integration with advertisers' product catalogs for seamless ad creation.

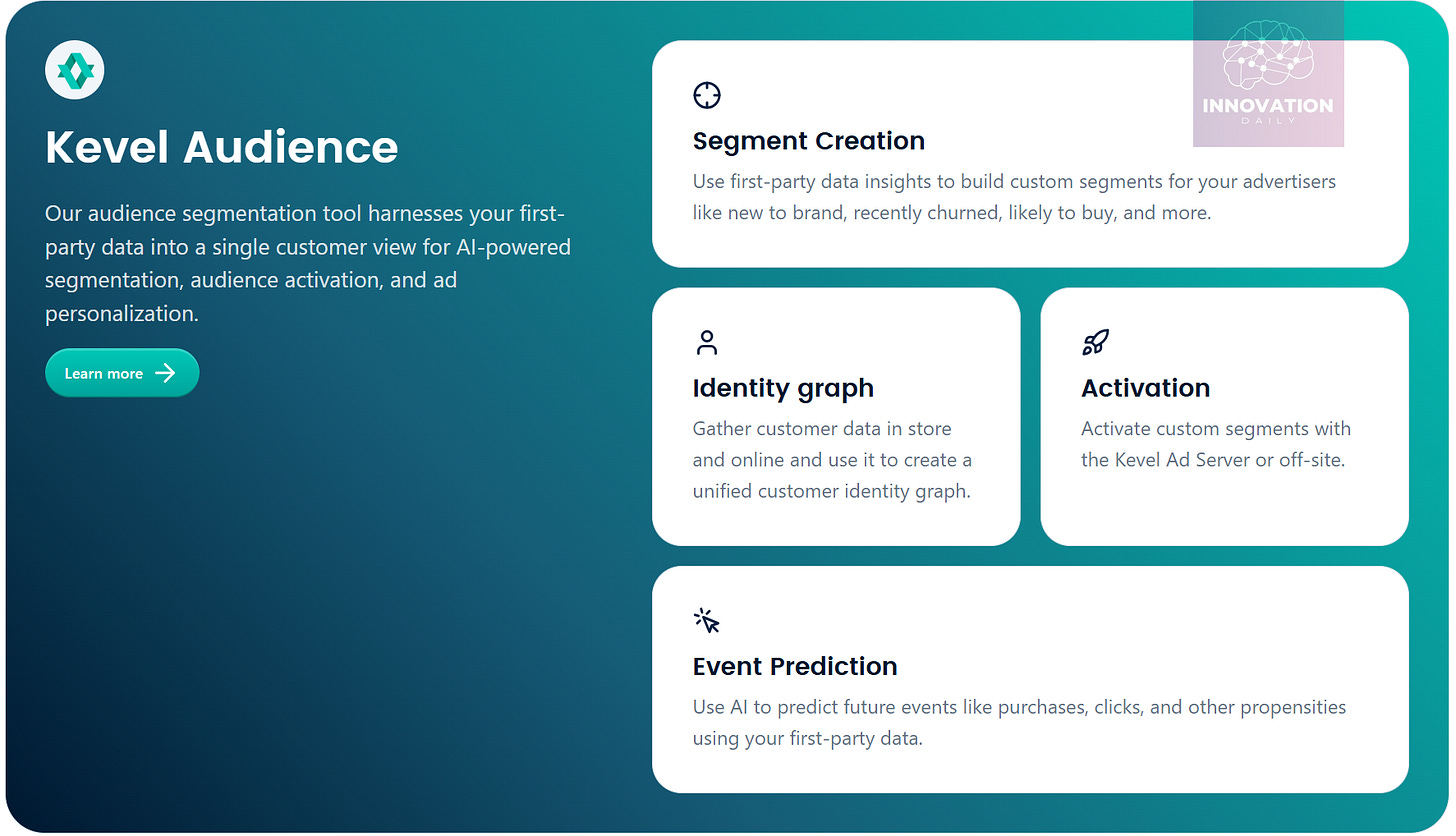

Targeting Engine — Automatically segments audiences and optimizes ad delivery based on campaign goals: impressions, clicks, or purchases.

The platform supports not only standard banners but also e-commerce-native formats like sponsored listings, product videos, and promotional blocks for sales and special offers.

Importantly, Kevel doesn’t take a revenue cut. Clients pay only for the infrastructure — based on the number of ad units and impressions. And since integration is API-driven, companies can embed Kevel however they like into their existing systems.

Kevel’s customer base includes small businesses, mid-sized players, and even giants like Delivery Hero. In one case, a modest car marketplace added seller ad placements via Kevel and boosted revenue by 30% — with 9x less development effort than building an ad platform from scratch.

The startup has now raised $23 million, bringing its total funding to $45.2 million.

What’s the Gist?

Why would marketplaces and e-commerce platforms bother with advertising when their core business is selling products?

Because ad revenue is incredibly profitable — and scalable.

Unlike product sales, where margins are tight, advertising offers high margins. Once the ad server is up and running, the only real costs are platform maintenance or licensing a solution like Kevel.

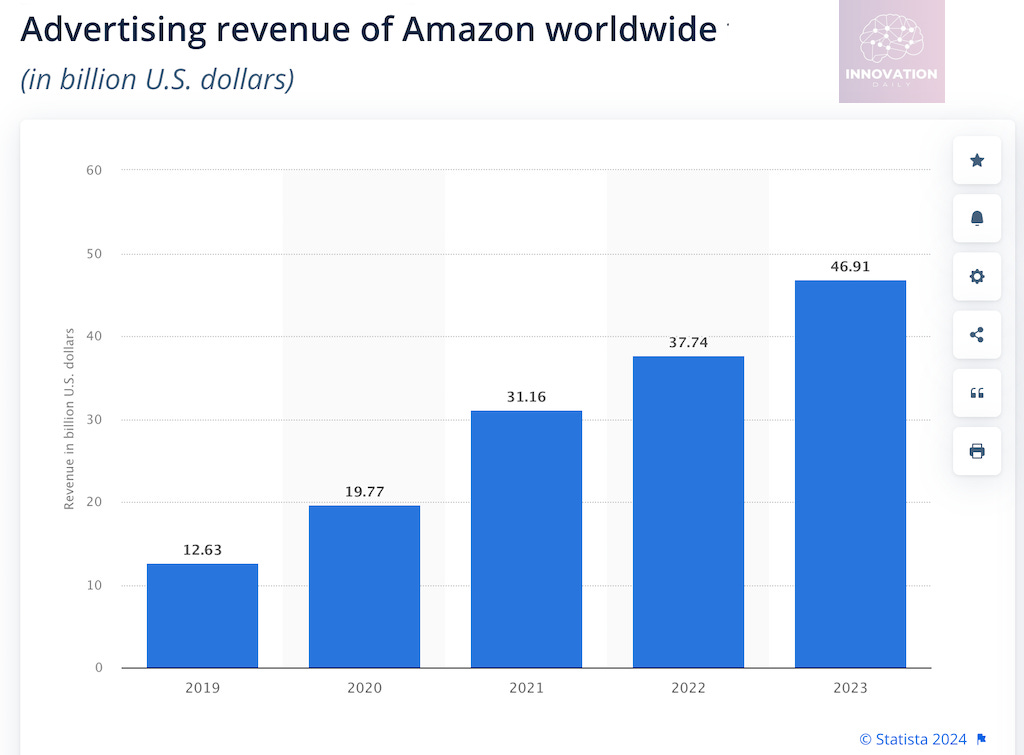

Just look at Amazon: in 2023, it earned nearly $47 billion from seller advertising — and that number keeps rising.

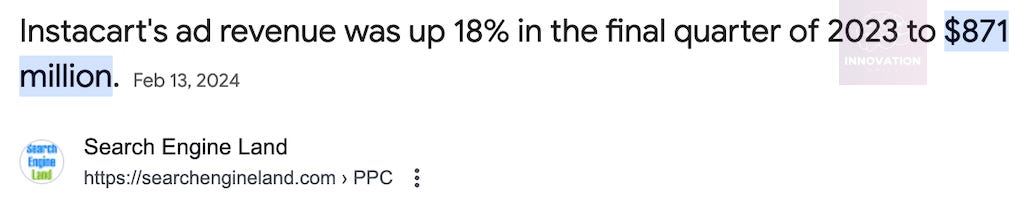

Even Instacart, which is tiny compared to Amazon, earned $871 million from retail media in just Q4 2023 — an 18% increase over the previous quarter. Advertising now accounts for almost 30% of Instacart’s total revenue. While their delivery volume remains flat, ad income is growing steadily.

This signals a major shift: e-commerce platforms are evolving into media businesses — making more money from ads than from selling goods.

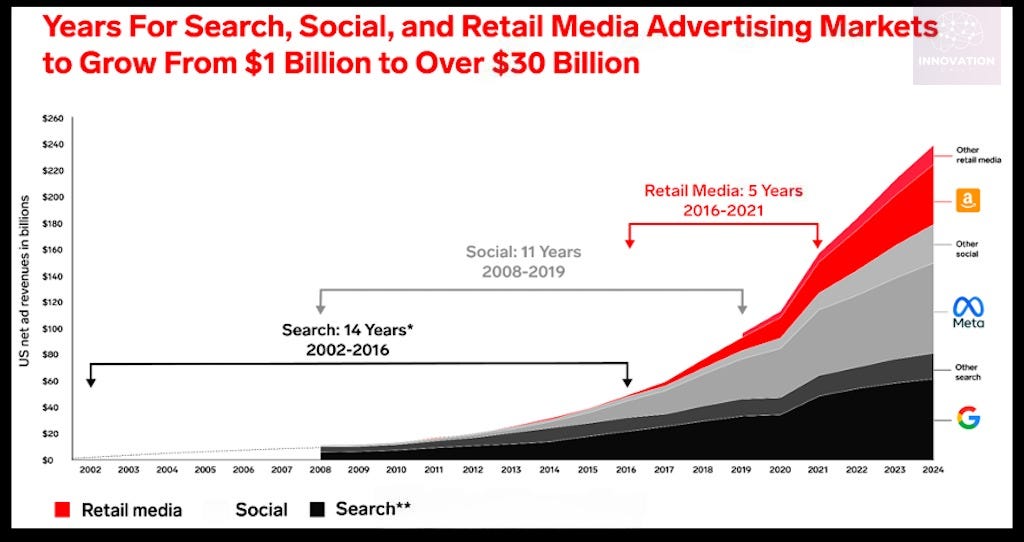

The retail media market itself is booming. For context:

Search ads took 14 years to grow from $1B to $30B.

Social media ads took 11 years.

Retail media did it in just 5 years (2016–2021).

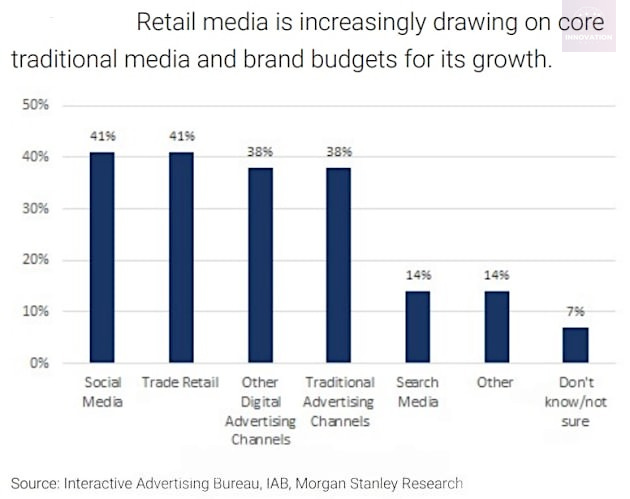

And it’s not slowing down. Advertisers now spend as much on retail media as on social media — and 3x more than on search ads.

Morgan Stanley forecasts retail media will soon hit $130 billion annually. Amazon currently owns 47% of that market. Other big players include Criteo (15%) and The Trade Desk (5%).

Everyone else — including Kevel — is fighting for the rest. And even 4th place in this space could be a multi-billion-dollar business.

Key Takeaways

Back in 2020, Andreessen Horowitz described how SaaS businesses evolve: from software licenses → cloud subscriptions → usage-based billing → free trials → freemium models.

Then came the Fintech Wave — cloud platforms began embedding financial services into their products to unlock new revenue streams.

Just look at Shopify. By 2020, it was already making twice as much from payments and merchant loans than from subscriptions. Today, 76% of Shopify’s revenue comes from financial services.

A similar trend is emerging in e-commerce. Retailers and marketplaces are monetizing credit offerings — from buy-now-pay-later to merchant financing.

Now, the next big monetization play is retail advertising. But building an ad platform in-house is no small feat. Amazon can afford it. Most others can’t — and that’s where Kevel comes in.

In short, Kevel represents a tool for enabling the next wave of platform monetization — by giving e-commerce companies an off-the-shelf retail media engine.

This market is far from saturated, with plenty of untapped players and room for multiple strong contenders. Now is a good time to enter.

Zooming out, a pattern emerges: as industries mature and margins shrink, players turn to adjacent, higher-margin revenue streams.

Cloud platforms lean into fintech.

E-commerce platforms lean into advertising.

And this logic can be extended further.

What’s the next mature market in need of new revenue sources?

Take the online education sector. Long-term, high-ticket courses are often paid via loans or installments — and banks capture all the interest.

Why shouldn’t education platforms become financial providers themselves? Why let banks take the cut?

So here’s the billion-dollar question:

Which other industry is ripe for monetization beyond its core business — and what kind of platform could unlock that potential?

The answer might be worth a unicorn.

Company Info

Kevel

Website: kevel.com

Last round: $23M, 07.03.2024

Total investment: $45.2M across 2 rounds