The Sushi Strategy

Today’s featured startup is combining familiar tools with bold strategy to help founders finally embrace financial management.

Project Overview

Scaleup Finance promises to help founders manage their startup finances “without fear, stress, or frustration.” Their target audience? Startup founders who are strong in product, marketing, or development—but not in finance. And yet, poor financial management is one of the top reasons even promising startups fail.

To fix this, Scaleup Finance offers a three-tiered financial management service:

A fractional CFO who builds the startup’s financial model, maintains forecasts, and advises the founder.

A dedicated platform for real-time financial data, metrics, and projections.

Outsourced accounting that includes bookkeeping, taxes, payroll, and payment workflows.

The startup launched in Denmark in 2021, entered the UK in 2022, and now supports over 150 startups. Revenue grew 10× in its first year on the UK market. With a fresh $8M in funding, its total raise now stands at $25.6M.

Scaleup Finance calls its model “CFO as a service”—a step beyond traditional accounting services and into strategic financial leadership, but without the full-time CFO price tag.

What’s the Gist?

The era of cheap money is over. Startups can no longer rely on easy fundraising and vague promises of growth. Investors demand numbers. Yet, hiring a qualified CFO remains too expensive for many founders.

That’s where Scaleup Finance steps in. They’re betting on the idea that “the era of overpriced financial management is over too.” Instead of trying to convince the market that startups should care about finance, they launched a solution exactly when founders were forced to.

It’s a classic case of timing:

Success isn’t about changing the world—it’s about catching the right wave.

And that wave, right now, is the shift toward lean, data-driven, financially accountable growth.

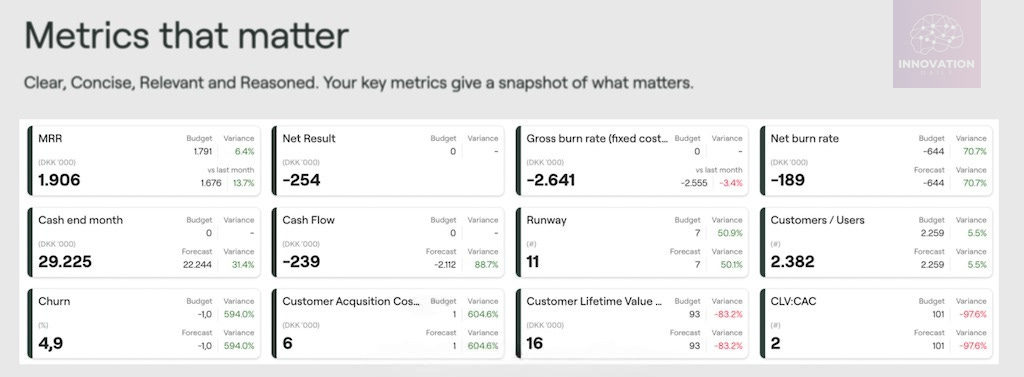

According to one Scaleup CFO, investors today expect three things:

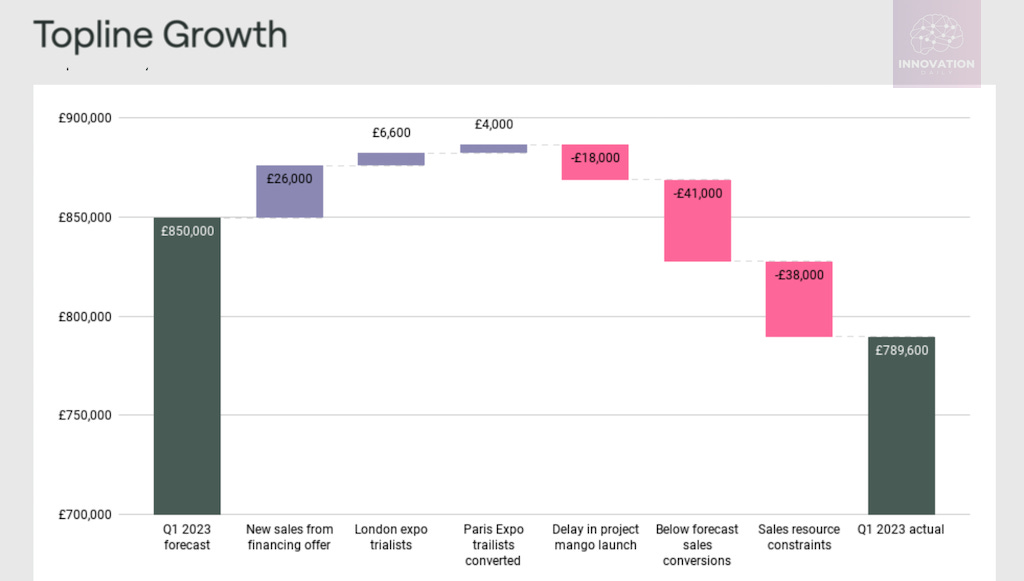

Up-to-date metrics that track performance in real time. Not just for investors—but for founders to stay ahead of issues.

Clear growth stories based on those metrics. Founders must not only show the big picture, but also trace problems back to individual numbers.

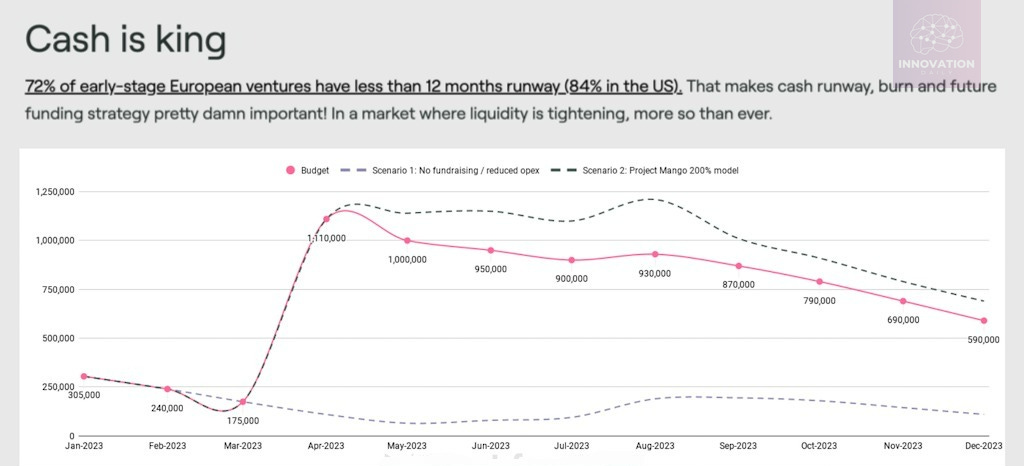

Cash runway visibility. Most startups have under 12 months of runway. Without solid cash tracking and forecasting, even minor setbacks can kill a company.

With Scaleup Finance, founders get all this—plus 90% of their financial admin is automated. Financial advice is available in minutes, not weeks.

Key Takeaways

We’ve had accounting-as-a-service for years. Scaleup Finance takes this one level higher—offering financial management-as-a-service, combining both accounting and strategic CFO support. And it’s a timely offering, given the current economic climate.

Still, focusing only on venture-backed startups is a mixed bag.

On the plus side, startup founders are natural early adopters.

But the real volume may lie in traditional businesses—early-stage companies that aren’t chasing VC money but still need sound financial strategy.

A version of Scaleup Finance tailored to these businesses might scale 10× faster.

Also worth noting: financial management platforms already exist. But Scaleup’s key differentiator is that it’s not just a platform. It’s a human + tech combo, pairing the founder with a real CFO, using a shared platform to build and maintain the financial engine of the business.

Think of it like the California roll of fintech.

When Japanese cuisine hit the US in the 1970s, Americans weren’t ready for raw fish or seaweed. Then came the California roll: familiar ingredients like rice, avocado, and crab—but in a new format. It helped Americans embrace sushi.

Scaleup Finance is doing the same. The outsourced accounting is the “rice and crab.” The strategic CFO work? That’s the seaweed. Familiar + unfamiliar in one package, easing people into a new way of thinking about finance.

The opportunity?

Build the California roll of financial services for non-startup businesses—companies that are just getting started or trying to scale. Bonus points if you tailor it to one sector where those companies are especially common.

Company Info

Scaleup Finance

Website: scaleup.finance

Last round: $8M, 26.03.2024

Total Investment: $25.6M, across 5 rounds